Analysts are highly optimistic about two Canadian mining stocks – Teck Resources Ltd. (TSE:TECK.B) and HudBay Minerals (TSE:HBM), as we enter March with more conviction in the sector. On TipRanks, analysts have awarded a Strong Buy consensus rating to these two stocks, with a potential to earn over 15% in the next twelve months.

Canada’s mining sector is one of the largest contributors to its growth, with the abundance of minerals and metals at its disposal. At the 2024 Prospectors and Developers Association of Canada (PDAC) convention held last week, the Canadian government decided to allot C$15 million to projects to enable indigenous participation and support the development of the domestic minerals sector

With this background in mind, let us look at the two Canadian mining companies with strong potential for growth in the coming months.

Teck Resources Ltd. (TSE:TECK.B)

Vancouver, BC-based Teck Resources Limited is a diversified natural resources company. Teck Resources engages in the mining and mineral development of steelmaking coal, copper, zinc, and energy. Its secondary product line includes lead, silver, gold, molybdenum, germanium, indium, and cadmium.

In its latest results for Q4 FY23, Teck Resources reported a record adjusted EBITDA of C$1.70 billion, backed by solid prices for steelmaking coal and copper and robust copper production. Also, revenue jumped 30.8% year-over-year to C$4.11 billion and adjusted earnings per share rose in tandem to C$1.40.

Moreover, Teck Resources’ board authorized a new share buyback plan of up to C$500 million and announced a quarterly cash common dividend of C$0.125 per share.

The company’s strategy is to focus on its base metals and copper portfolio. To align with the same, Teck Resources completed the full sale of its steelmaking coal business Elk Valley Resources to Glencore plc (GB:GLEN) at an implied enterprise value of US$9 billion on January 3, 2024.

Is Teck Resources a Good Buy?

On TipRanks, TECK.B shares command a Strong Buy consensus rating based on 11 Buys versus one Sell rating. The average Teck Resources Class B share price target of C$63.92 implies 14.6% upside potential from current levels. In the past year, TECK.B stock has gained 12.8%.

HudBay Minerals (TSE:HBM)

Toronto-based HudBay Minerals is a copper-focused mining company with a long-life and low-cost pipeline of copper growth projects in mining-friendly regions of Canada, Peru, and the U.S. The company’s copper exploration is complemented by meaningful gold production as well as silver, zinc, and molybdenum production. In February, HudBay announced a semi-annual dividend of C$0.01 per share, payable on March 22, 2024.

In Q4 FY23, HudBay’s revenues grew 87.5% year-over-year to $602.19 million, boosted by solid copper production of 45,450 tonnes. Furthermore, HudBay produced 112,776 ounces of gold in the quarter. The company reported adjusted earnings per share of $0.20, up significantly from $0.01 reported in Q4 FY22.

Importantly, for Fiscal 2024, HudBay expects copper production to grow by 19% to 156,500 tonnes and gold production to decline marginally to 291,000 ounces.

Is HudBay Minerals a Buy?

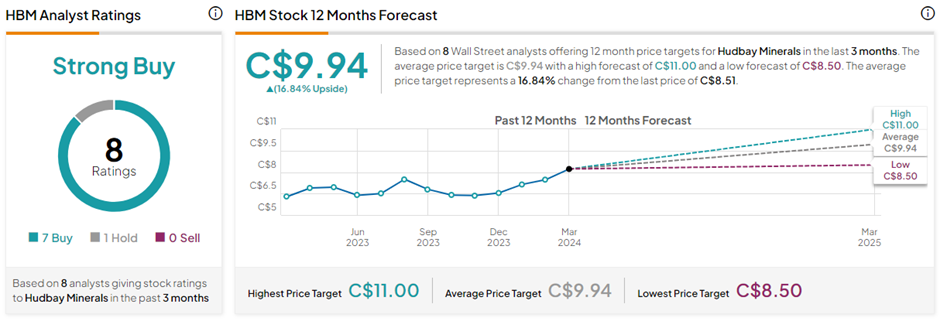

With seven Buys versus one Hold rating, HBM stock has a Strong Buy consensus rating on TipRanks. The average HudBay Minerals share price forecast of C$9.94 implies 16.8% upside potential from current levels. HBM stock has gained 34.9% in the past year.

Key Takeaways

The Canadian mining sector is expected to witness robust growth in the coming months, driven by solid government support. Investors could consider investing in mining stocks to enhance their portfolio returns with solid upside potential, analyst conviction, and attractive dividends.