Big Tech stocks rose briefly on Thursday morning after a U.S. trade court ruled that most of the tariffs set by former President Trump are illegal. However, the gains didn’t last after analysts said that the court ruling may not have much of a real impact since the Trump administration still has ways to work around it. For example, Goldman Sachs said that this might not actually change how the U.S. handles trade with most countries.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Unsurprisingly, Trump’s shifting trade policies have caused a lot of volatility for tech stocks. Indeed, in April, he announced a set of steep tariffs on major trading partners that cut over $2 trillion from the total value of the “Magnificent Seven” tech companies. Although a 10% baseline tariff was introduced, and tariffs on China went as high as 145%, some consumer tech items were temporarily exempted. A short trade truce between the U.S. and China also helped lower tariffs on some items, which briefly lifted tech stocks. Still, last week, Trump said that Apple must pay a 25% tariff unless it makes iPhones in the U.S.

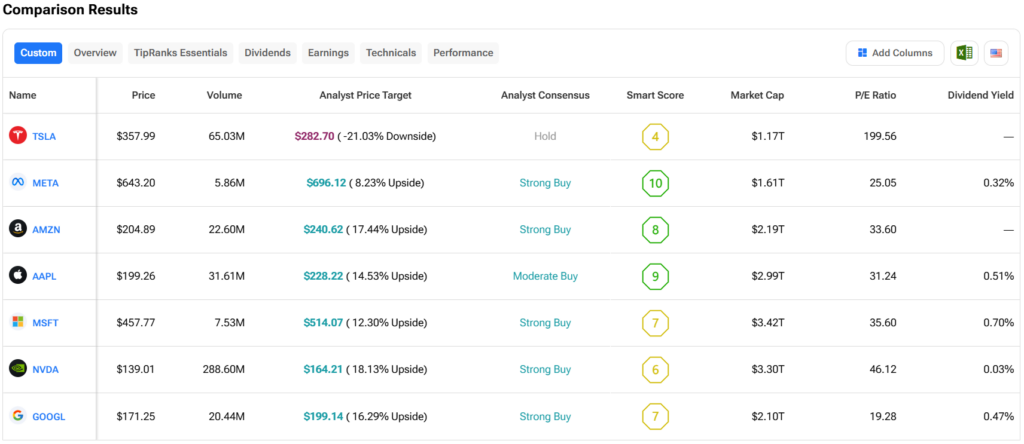

As of now, Big Tech is still struggling in 2025. In fact, Apple (AAPL) stock is down almost 20%, while Google (GOOGL), Amazon (AMZN), and Tesla (TSLA) are down 9%, 8%, and 11%, respectively. However, Nvidia (NVDA) turned green for the year after showing strong demand for its AI chips, even though its H20 chips were recently banned from export to China.

Which Magnificent Seven Stock Is the Best Buy?

Turning to Wall Street, analysts think that NVDA stock has the most room to run. In fact, NVDA’s average price target of $164.21 per share implies more than 18% upside potential. On the other hand, analysts expect the least from TSLA stock, as its average price target of $282.70 equates to a loss of 21%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue