Shares of Toronto-Dominion Bank (TD) fell nearly 2% in early trading Thursday, even after Canada’s largest bank posted better-than-expected earnings in its third quarter. Quarterly profit increased, as the bank recovered credit losses and earned higher revenue from its Canadian and U.S. retail businesses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Profit came in at C$3.55 billion (C$1.92 per diluted share) for Q3 2021, up 57.7% from a profit of C$2.25 billion (C$1.21per share) in Q3 2020. On an adjusted basis, TD earned C$1.96 per diluted share in its latest quarter, up from C$1.25 per diluted share in the prior-year quarter. The consensus was for adjusted earnings of C$1.90 per share.

Revenue totaled C$10.71 billion in the quarter ended July 31, up 0.4% from C$10.67 billion a year ago. Analysts expected revenue of C$10.1 billion. (See TD stock charts on TipRanks)

TD’s Canadian Retail operations saw net income soar 68% year-over-year to C$2.13 billion.

Meanwhile, its U.S. Retail business earned C$1.3 billion, up 92% from a year ago.

The bank’s Wholesale Banking unit posted a 25% decrease in net income to C$330 million. TD’s Common Equity Tier 1 Capital ratio was 14.5% in the third quarter, compared to 12.5% in the prior-year quarter.

TD Bank Group president and CEO Bharat Masranai said, “TD’s strategy – anchored in our proven business model – enabled us once again to deliver for our shareholders, meet the needs of our customers and clients and contribute to the economic recovery, while continuing to invest in our people, technology, and capabilities.”

On August 26, Canaccord Genuity analyst Scott Chan maintained a Hold rating on the stock, with a C$87.50 price target. This implies 3.1% upside potential.

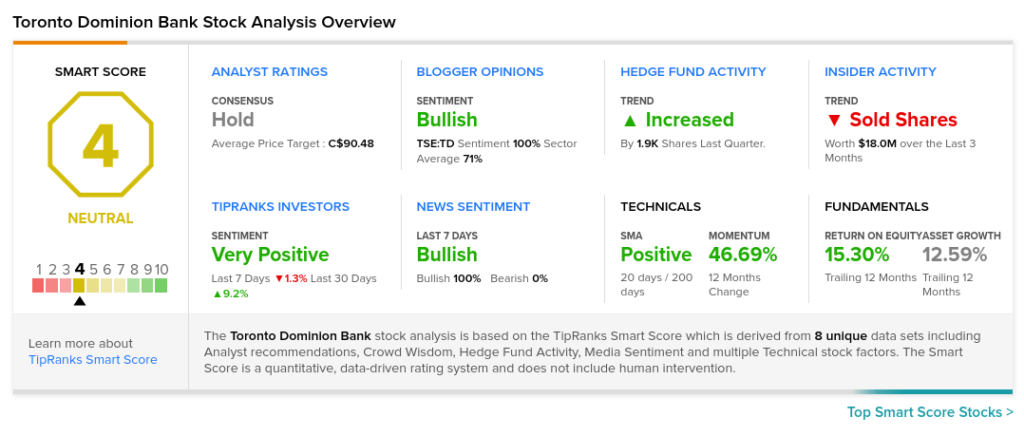

Overall, TD scores a Hold rating among Wall Street analysts based on one Buy, six Holds, and one Sell. The average Toronto-Dominion Bank price target of C$90.48 implies 6.6% upside potential to current levels.

TipRanks’ Smart Score

TD scores a 4 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to be in line with the overall market.

Related News:

CIBC Q3 Profit Rises 48%, Tops Expectations

TD Bank Q3 Earnings Preview: What to Expect

TD Insurance Launches New Severe Weather & Safety Alerts