Canadian Imperial Bank of Commerce (CM), Canada’s fifth-largest bank, posted strong Q3 profits, driven by a rebound in loan revenue and a recovery in loan loss provisions.

Total revenue increased 7.4% year-over-year to C$5.06 billion, beating estimates of C$4.92 billion. Profit came in at C$1.73 billion (C$3.76 per diluted share) in the third quarter of 2021, up from C$1.17 billion (C$2.55 per diluted share), in the same quarter a year ago. CIBC earned C$3.93 per diluted share on an adjusted basis, which was much higher than the consensus estimate of C$3.42 per share.

The lender benefited from a significantly improved credit outlook, by releasing C$99 million of funds that had been set aside for bad debts. (See CM stock charts on TipRanks)

Profits at CIBC’s Canadian Personal and Business Banking unit came in at C$642 million, up 40% from a year earlier.

For the Canadian Commercial Banking and Wealth Management unit, profit increased 47% year-on-year to C$470 million, mainly due to higher revenues and a reversal of loan loss provisions during the current quarter.

Adjusted profits from U.S. Commercial Banking and Wealth Management rose 272% to C$279 million, due to a sharp reversal in bad debt provisions.

Capital Markets profit climbed to C$491 million, an increase of 11% from the prior-year quarter.

CIBC president and CEO Victor Dodig said, “We continue to deliver purpose-driven growth across all of our business units as we work with our clients to help them achieve their ambitions. This quarter’s record top-line revenue and earnings per share underscore the breadth and quality of the growth we have across all of our key business units, as we continue to successfully navigate an uncertain environment by staying focused on our clients and on the wellbeing of our team.

“This quarter we continued to make strategic investments in our future growth as we have throughout the pandemic.”

CIBC also announced Thursday its ambition to achieve zero net greenhouse gas emissions associated with operational and financial activities by 2050.

On August 26, Canaccord Genuity analyst Scott Chan maintained a Buy rating on the stock with a C$157 price target. This implies 3.7% upside potential.

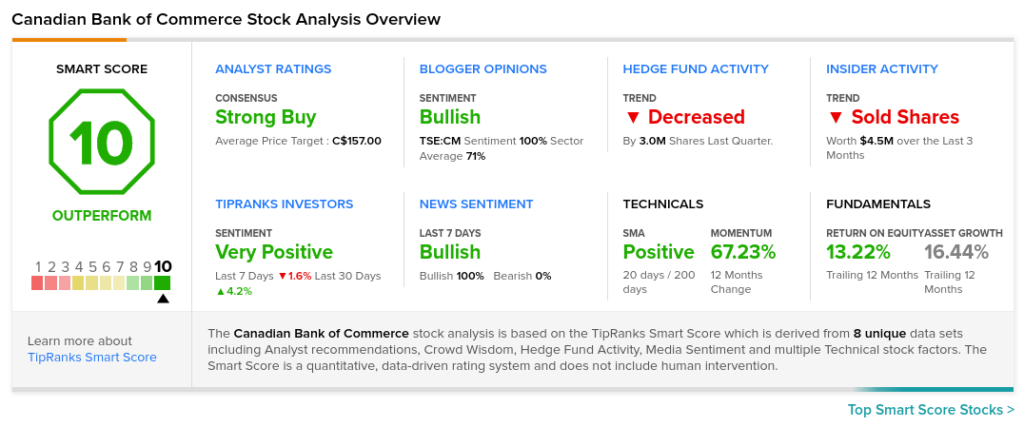

The rest of the Street is bullish on CM, with a Strong Buy consensus rating, based on seven Buys and one Hold. The average Canadian Imperial Bank of Commerce price target of C$157 implies 3.7% upside potential to current levels.

TipRanks’ Smart Score

CM scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

CIBC Q3 Earnings Preview: What to Expect

Royal Bank Q3 Profit Beats Expectations

Scotiabank Q3 Profit Beats Expectations