The shareholders of Taubman Centers have approved the company’s merger with real estate company Simon Property Group. The deal is likely to close either this week or in early 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, in November, Simon Property had offered $43 a share to acquire Taubman Centers (TCO). However, the deal price was cut lower from its previous offer of $52.2 per share proposed back in February. TCO have gained 27% over the past 3 months.

Per the revised deal agreement, Simon Property (SPG) will buy an 80% stake in the Taubman Realty Group Limited Partnership (TRG). Further, the company said, “The Taubman family will sell approximately one-third of its ownership interest at the transaction price and remain a 20% partner in TRG.” Additionally, Taubman will “not declare or pay a dividend on its common stock prior to March 1, 2021, and then, only subject to certain limitations and conditions.”

Earlier in June, Simon Property sued Taubman and terminated its initial acquisition offer as Taubman’s revenues as well as its shares suffered amid the pandemic. In response, Taubman countersued Simon and forced it to complete the deal. (See TCO stock analysis on TipRanks)

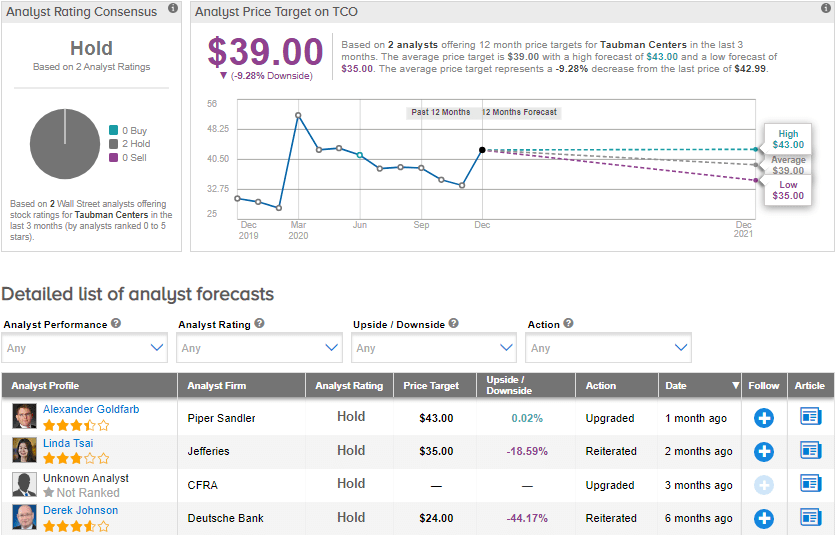

Following the revised merger, Piper Sandler analyst Alexander Goldfarb on Nov. 16 upgraded Taubman stock to Hold from Sell and maintained a price target of $43 (0.02% upside potential). The analyst said, “the outcome is better than we would have expected, as shareholders get cashed out at a valuation well in excess of mall multiples, while the company avoids protracted litigation.”

The Street is currently in line with Goldfarb’s outlook with a Hold analyst consensus. The average price target stands at $39, implying downside potential of about 9.3% to current levels. Shares have increased by about 38.3% year-to-date.

Related News:

Simon Property, Taubman Agree On Lower Price In Merger Deal; Stock Gains

RMG Shareholders Approve Romeo Systems Merger; Shares Climb 5%

Vectrus to Acquire Zenetex for $112M; Analyst Says ‘Buy’