Real estate company Simon Property Group (SPG) has lowered its offering price to buy Taubman Centers to $43 per share from the $52.2 per share proposed back in February. Shares of Simon Property are up 4.4% in pre-market trading on Monday, while Taubman shares jumped over 8%.

Both the companies’ boards have approved the revised merger agreement and the deal is likely to close in late 2020 or early 2021.

Back in June, Simon sued Taubman (TCO) and terminated its initial $3.6 billion acquisition offer as Taubman’s stock price suffered and revenue was also significantly impacted amid the pandemic. Taubman countersued and forced Simon to complete the transaction.

Per the revised merger agreement, Simon will purchase an 80% stake in the Taubman Realty Group Limited Partnership (TRG). The company said that “The Taubman family will sell approximately one-third of its ownership interest at the transaction price and remain a 20% partner in TRG.” Also, Taubman will “not declare or pay a dividend on its common stock prior to March 1, 2021, and then, only subject to certain limitations and conditions.” (See SPG stock analysis on TipRanks).

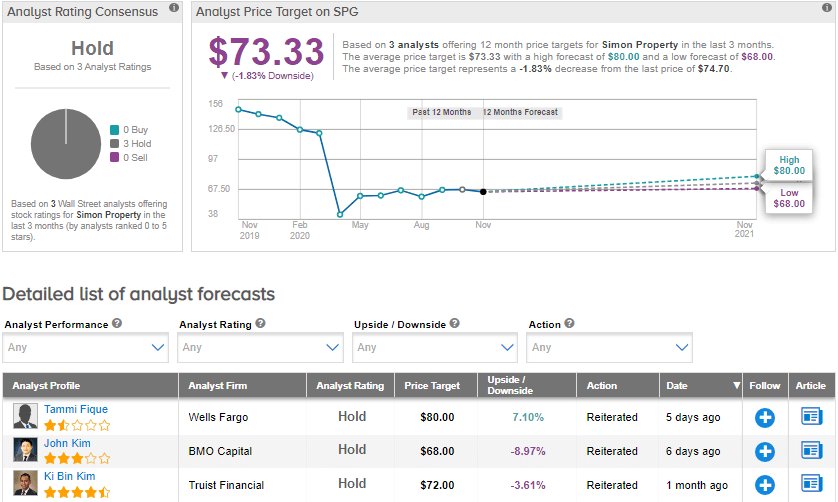

On Nov. 11, Wells Fargo analyst Tammi Fique raised SPG’s price target to $80 (7.1% upside potential) from $70 but maintained a Hold rating. The analyst said that the 3Q results reflect significant NOI [net operating income] pressure related to COVID-19. Nevertheless, Fique continues to view Simon more favourably versus other mall REIT peers, given its superior balance sheet, diversified product and geography. The analyst, however, prefers to remain sidelined on the stock amid the headwinds related to rent collections, expectations for continued store rationalizations and bankruptcies by retailers, and the growing e-commerce market.

The rest of the Street is in line with Fique’s outlook with a Hold analyst consensus. The average price target stands at $73.33, which implies downside potential of about 1.8% to current levels. Shares have declined by about 50% year-to-date.

Related News:

Simon Property Misses 3Q Sales Estimates; Shares Slip 4%

Postal Realty’s 3Q Sales More Than Double; BMO Sees 22% Upside

Rocket’s 3Q Sales Explode 163% On Home Loan Demand; Street Sees 24% Upside