It was a huge day for retail chain Target (NYSE:TGT), who saw share prices surge over 12% during Tuesday afternoon’s trading. The biggest reason traces back to an impressive, if flawed, earnings report. However, plans for a new subscription service emerged, a move that has investors very interested.

The new subscription program, dubbed “Target Circle 360,” will take a page out of the playbooks of Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT), giving paying customers access to new services, like same-day delivery on orders over $35, two-day free shipping, and other perks. In fact, it’s looking into a range of other options as well. Those who buy in before May 18 will pay $49 per year. Buying after then sees the price nearly double to $99 per year.

Oddly Interested

In what may prove the oddest twist of all, Target is surging despite a potential flaw in its earnings. While it turned in great results this time around, posting beats for earnings and revenue, reports noted that its comparable-store and online sales both declined year-over-year. This is actually the third quarter in a row that sales have posted such a decline.

However, there are some signs that this may change; Target is taking advantage of an approaching spring by rolling out a series of deals for the home gardener, with prices starting around $5. That might help perk some sales up a bit as people look forward to more time outdoors. Certainly, the addition of free shipping and rapid delivery won’t hurt there either, assuming people are willing to pay Target to ship things they can probably just pick up themselves anyway.

Is Target a Buy, Sell, or Hold?

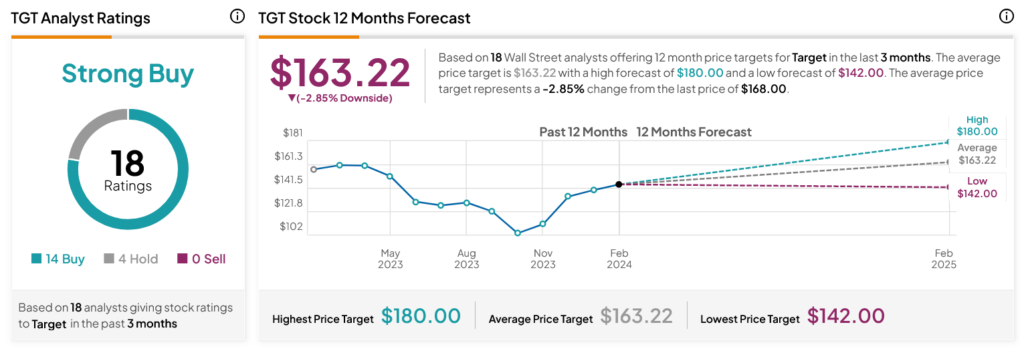

Turning to Wall Street, analysts have a Strong Buy consensus rating on TGT stock based on 14 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 5.65% rally in its share price over the past year, the average TGT price target of $163.22 per share implies 2.85% downside risk.