Citi analyst Jason Bazinet has turned bullish on the shares of the videogame publisher Take-Two Interactive Software (NASDAQ:TTWO). The five-star analyst, with an average return of 7.3% and a success rate of 100% on TTWO, finds the stock’s risk-reward compelling. Bazinet upgraded the TTWO to Buy from Hold on April 8. Moreover, the analyst increased the price target to $200 from $170. The new price target suggests over 30% upside potential from current levels.

Notably, Take-Two stock came under pressure after the company announced that it was experiencing softness in mobile advertising and sales of the video game, NBA 2K24. Further, uncertainties surrounding the release of the new Grand Theft Auto videogame (GTA VI) remain a concern.

Bazinet acknowledged the uncertainty related to the launch of GTA VI, trends within the mobile portfolio, and the magnitude of GTA VI bookings. However, considering the significant revenue opportunities from GTA VI, the analyst finds TTWO stock compelling near the current levels.

Is Take-Two a Buy or Sell?

Take-Two stock is down about 4.5% year-to-date, underperforming the S&P 500’s (SPX) nearly 9% gain. However, analysts are bullish about its prospects.

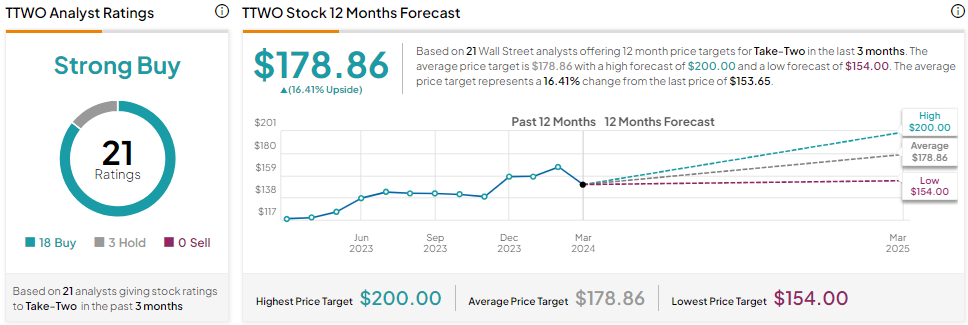

Take-Two stock sports a Strong Buy consensus rating based on 18 Buy and three Hold recommendations. The analysts’ average TTWO stock price target of $178.86 implies 16.41% upside potential.