While much of the tech sector is experiencing layoffs, there’s one chip stock that’s bucking the trend: Taiwan Semiconductor (NYSE:TSM). Investors, meanwhile, aren’t exactly pleased about this development and have responded by sending shares down around 1.5% during Wednesday afternoon’s trading.

The latest reports suggest that Taiwan Semiconductor may be planning to take advantage of some of the layoffs to attract talent. Taiwan Semiconductor looks to have as many as 100,000 employees worldwide within the next few years.

It certainly doesn’t hurt that the company managed to get back onto the list of the 10 most valuable companies in the world, which will likely give it some prestige in attracting talent. However, getting to 100,000 will take a significant push, as Taiwan Semiconductor currently has about 77,000 employees.

A Fractious Chip Market

It was just two days ago when we saw some new fallout of the ongoing battle of chip embargoes. China, likely tired of being the whipping boy for chip importers, declared Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD) chips unwelcomed when it came to any government computer purchase. While the move was a reasonable one—China wants to focus on domestic chip producers—some question just how far the Chinese chip market can actually carry its own operations.

While this may not have much impact on Taiwan Semiconductor, it does illustrate how volatile the chip market can be. That, in turn, offers some perspective on why Taiwan Semiconductor is planning a huge hiring spree in an era when everyone else is laying off.

Is Taiwan Semiconductor a Buy, Sell, or Hold?

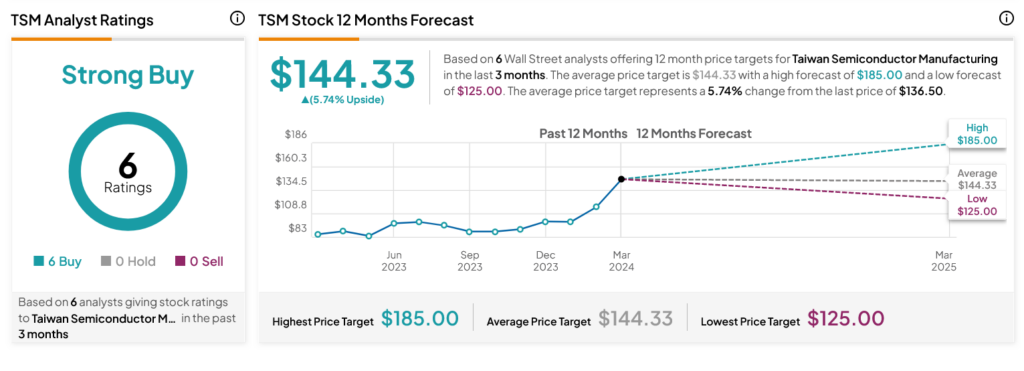

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSM stock based on six Buys assigned in the past three months, as indicated by the graphic below. After a 52.32% rally in its share price over the past year, the average TSM price target of $144.33 per share implies 5.74% upside potential.