Shares of contract manufacturer Taiwan Semiconductor Manufacturing (TSM) closed 5.5% lower on Thursday despite the company reporting year-over-year growth in revenues and earnings in its second-quarter financial results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lower-than-expected gross profit margin and tepid third-quarter gross margin outlook led to the plunge in share price. The company was in focus as it was expected to have benefited from the current global chip shortage, as well as strength in the Taiwan dollar during the second quarter.

Quarterly earnings stood at 19 cents, up from 17 cents in the year-ago quarter. However, EPS missed the Street’s estimates of 93 cents. (See Taiwan Semiconductor stock charts on TipRanks)

Quarterly revenue of $13.29 billion was up 28% on a reported basis year-on-year, surpassing analysts’ expectations of $13.17 billion.

The company expects third-quarter 2021 revenues to be between $14.6 billion and $14.9 billion, and gross profit margins of between 49.5% and 51.5%.

Wendell Huang, VP and Chief Financial Officer of Taiwan Semiconductor, said, “Our second quarter business was mainly driven by continued strength in HPC and Automotive-related demand”. He added, “Moving into third quarter 2021, we expect our business to be supported by strong demand for our industry-leading 5nm and 7nm technologies, driven by all four growth platforms, which are smartphone, HPC, IoT and Automotive-related applications.”

Following the earnings release, Morgan Stanley analyst Charlie Chan said, “We still believe at some point in 2022 and 2023, TSMC’s gross margin will fall below 50% given the steep increase in depreciation cost, while the company doesn’t seem to be demonstrating pricing power.” Further, he said, “Or, simply as indicated, Moore’s Law is just getting too expensive while TSMC will have to suffer margin erosion to keep the chip scaling trend going.”

However, Needham Charles Shi reiterated a Buy rating on the stock, while raising the price target to $138 from $135.

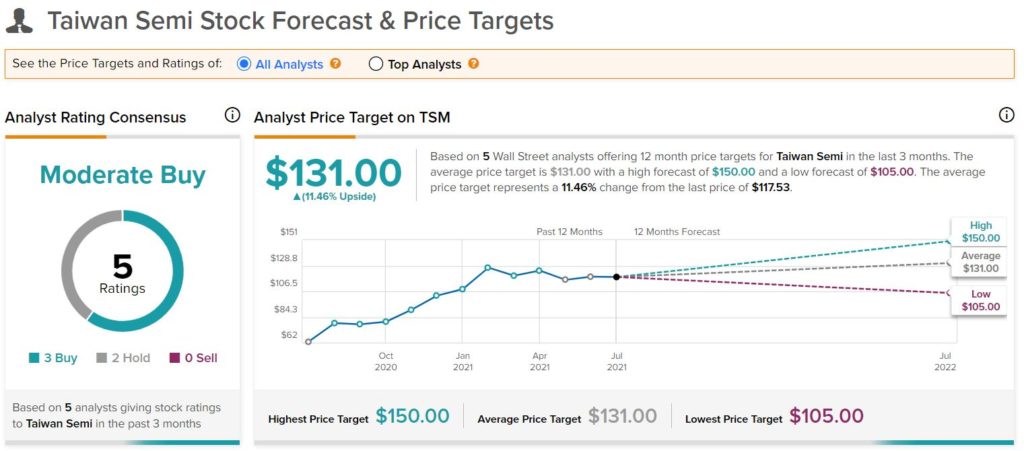

Consensus among analysts is a Moderate Buy based on 3 Buys and 2 Holds. The average Taiwan Semiconductor price target of $131 implies 11.5% upside potential to current levels.

Recent News:

Wells Fargo Q2 Earnings & Estimates Surpass Estimates

Aspen’s Q4 Revenue Jumps 35%; Street Says Buy

NortonLifeLock and Avast in Talks of a Possible Merger