American multinational financial services company Wells Fargo (WFC) reported strong Q2 2021 results on the back of improvement in credit quality and prudent cost management.

Earnings came in at $1.38 per share and surpassed consensus estimate of $0.97 per share. The company reported Q2 revenue of $20.3 billion, up 11% from the previous year’s quarter, and surpassed analysts’ estimates of $17.8 billion.

The top-line growth was driven by higher revenues from its mortgage banking business. Also, investment advisory and other asset-based fees increased on account of higher market valuations, and card and deposit-related fees. Net interest margin contracted 23 basis points to 2.02%.

Non-interest expense during the quarter declined 8% to $13.3 billion on efficiency initiatives, fall in deferred compensation plan and lower salaries expense. (See Wells Fargo stock chart on TipRanks)

Notably, provision for credit losses fell $10.8 billion in Q2 on improving economic conditions. Net charge-offs were down significantly from last year.

CEO of Wells Fargo Charlie Scharf said, “We are investing in our business to improve our competitive position for the future and our recent launch of our redesigned Wells Fargo Active CashSM Card, one of the industry’s best cash back cards, …but we are also working across the company on products and capabilities to compete effectively in today’s dynamic environment.”

Following the earnings release, Oppenheimer analyst Chris Kotowski assigned a Hold rating to the stock.

Kotowski said, “We are bumping up our 2022 estimate primarily on the strength of higher mortgage banking revenues, which continue to do well, but also in part on generally stronger fee income. We continue to think that the turnaround will happen but that it will take longer than the Street generally expects.”

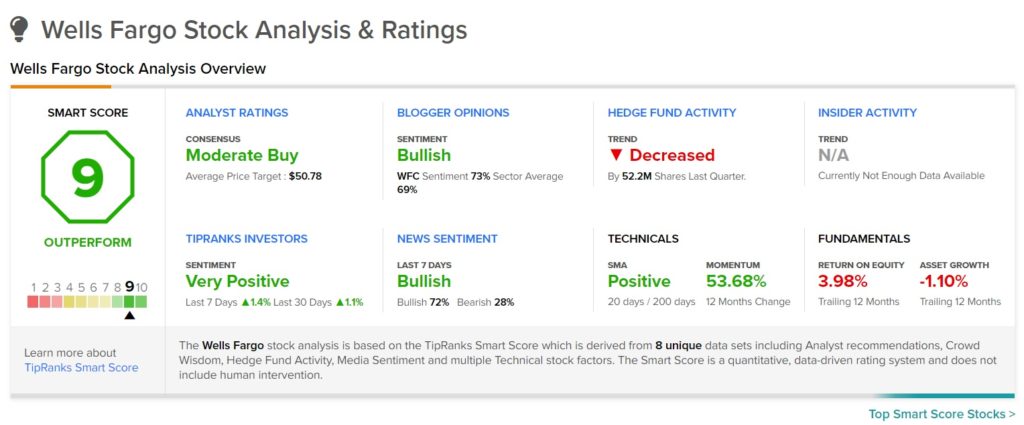

Based on 7 Buys and 5 Holds, the stock has a Moderate Buy consensus. The average Wells Fargo price target of $50.78 implies 12.4% upside potential from current levels.

WFC scores a 9 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Related News:

L Brands Announces Commencement of Secondary Offering, Buyback of Common Stock

Ally Financial Gets Share Buyback Authorization, Hikes Common Stock Dividend

Goldman Sachs Reports Blowout Q2 Results; Hikes Dividend by 60%