T-Mobile (TMUS), the U.S.-based provider of wireless communication services, has entered into a partnership with Fox (FOX) to supply superior network coverage to power the broadcasting company’s extreme-weather coverage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, investors are not impressed as TMUS stock dipped during trading hours on Wednesday afternoon. The arrangement comes as T-Mobile is preparing to release its third quarter 2025 results tomorrow.

Wall Street is expecting lower earnings per share compared to the same period last year. The telecom operator’s revenue is also anticipated to jump by approximately 9% year-over-year to $21.91 billion.

Fox Taps T-Mobile’s SuperMobile

Under the arrangement with Fox, T-Mobile will provide robust network coverage under its SuperMobile offering, which is a plan targeted at business users. SuperMobile offers advanced 5G features, built-in security, and satellite backup.

Fox expects the service to enable its weather service to be broadcast from any part of the U.S. with uninterrupted network provision, even during adverse weather events such as hurricanes and tornadoes.

“Reporters can livestream from the heart of the storm, share radar imagery in real time, and send critical updates to producers and audiences — even during times of high network demand,” Fox noted.

T-Mobile Rides Growth Wave

The partnership comes as T-Mobile continues to outperform its rivals such as Verizon (VZ) and AT&T (T). Verizon, for instance, is battling net losses from its postpaid phone subscriber base as competition continues to heat up in the industry.

In contrast, T-Mobile, which was established about three decades ago, achieved its biggest second-quarter growth earlier this year. This is even as the company’s postpaid service saw the average revenue per user expand by 5% to the highest figure in eight years.

Is TMUS a Good Stock to Buy Now?

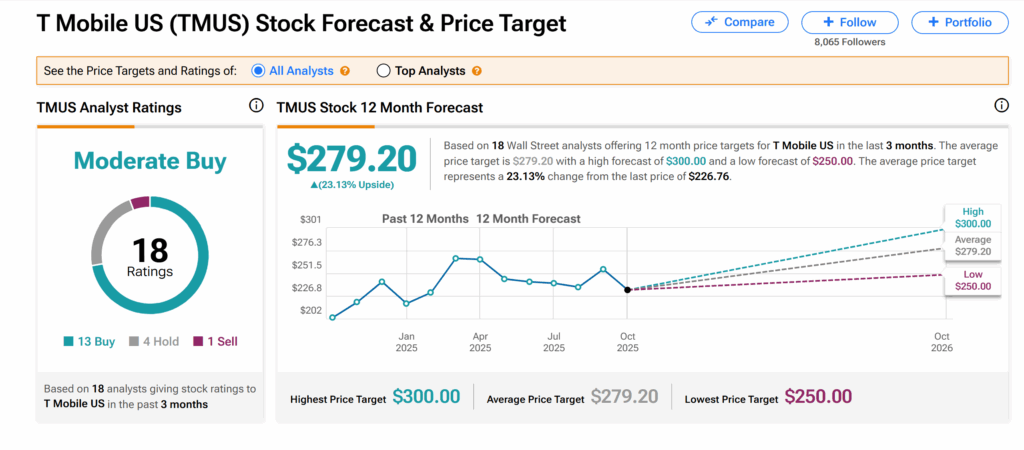

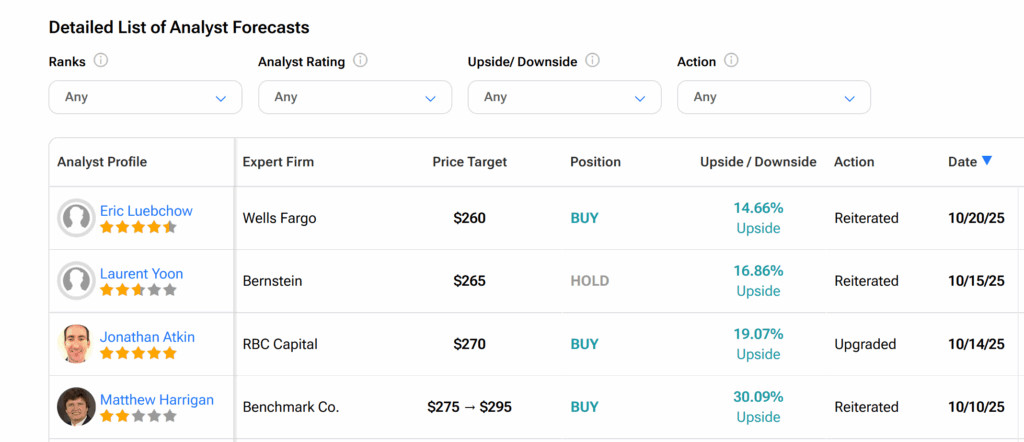

However, on Wall Street, T-Mobile’s shares currently hold a Moderate Buy consensus rating, according to TipRanks data. This is based on 13 Buys, four Holds, and one Sell recommendation issued by 18 Wall Street analysts over the past three months.

Moreover, the average TMUS price target of $279.20 indicates a 23% growth potential from the current level.