T-Mobile US (TMUS) continues to outperform peers with substantial subscriber additions and consistent operational execution. The company’s relentless focus on customer acquisition — including its aggressive $800 buyout offers for switchers — has sustained growth while rivals Verizon and AT&T have scaled back their promotions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The result has seen TMUS surfing an almighty crest of a growth wave, going back to 2023. Market participants tested the stock’s $250 highs already once this year, with another attempt now looking likely following TMUS’ latest exploits.

Moreover, the telecoms giant has also intensified marketing efforts around the latest iPhone launch, introducing “no trade-in” promotions to attract new customers. This steady stream of incentives underscores the company’s ability to maintain subscriber momentum even in a competitive wireless environment. With positive catalyst-inducing news trickling in, I remain a TMUS bull.

Flurry of Developments at T-Mobile US

The July commercial launch of T-Satellite, which initially supports text messaging with voice and data expected to follow, further strengthens T-Mobile’s value proposition. The service expands coverage to remote areas and could boost demand for higher-tier plans. The company’s leadership in nationwide 5G deployment — widely recognized as the most advanced in the U.S. — continues to provide a clear competitive edge.

In addition, T-Mobile is increasing its focus on the business market, where it remains underrepresented compared to its peers. The launch of SuperMobile earlier this year introduced network slicing and built-in security for enterprise customers. The rollout of T-Priority, a premium enterprise service, demonstrates management’s intent to diversify revenue beyond the consumer market.

Another key growth lever is the pending U.S. Cellular (USM) acquisition, announced in July. T-Mobile will acquire all of U.S. Cellular’s wireless operations — including customers, stores, and select spectrum assets — for approximately $4.4 billion. The integration should expand the company’s rural footprint and generate an estimated $1.2 billion in synergies, improving both reach and scale over the next two years.

Fiber Expansion Adds a New Layer of Growth

T-Mobile is set to launch its T-Fiber business later this quarter, aiming to leverage its powerful national brand and marketing engine to scale rapidly. With a waitlist exceeding one million potential high-speed internet customers, the fiber rollout represents a major opportunity for T-Mobile to capture additional broadband market share.

The company’s industry-leading 5G network, coupled with expanding fiber and satellite capabilities, positions it uniquely to serve both densely populated and underserved regions. This integrated connectivity strategy—uniting mobile, fiber, and satellite—should not only strengthen customer loyalty but also enhance long-term cash flow generation.

Financially, the T-Fiber initiative has the potential to boost return on capital (ROC) and economic profit by increasing average revenue per user (ARPU) and reducing customer churn. Backed by management’s disciplined capital allocation and focus on “smart growth,” T-Mobile appears well-positioned to continue delivering sustainable shareholder value creation in the years ahead.

AI Innovation Enhances Efficiency

T-Mobile is increasingly weaving artificial intelligence (AI) into the fabric of its operations and service offerings. The company is deploying AI across its cloud-based communications platform, unifying voice, video, and messaging tools for businesses to streamline workflows and enhance productivity.

On the operational side, T-Mobile leverages AI to manage its radio access network (RAN), processing millions of data points each day to optimize connectivity and network capacity. These self-healing network systems automatically reroute resources to preserve performance and reliability, even under heavy demand.

In a significant step forward, T-Mobile recently announced a multi-year partnership with OpenAI to create an AI-driven customer support platform that blends OpenAI’s advanced models with T-Mobile’s proprietary customer data. The collaboration aims to elevate the customer experience, lower support costs, and further distinguish the brand in a competitive market.

While these AI initiatives may not immediately impact financial results, they lay a strong foundation for long-term operating efficiency and growth. As 5G and next-generation networks mature, T-Mobile’s intelligent automation strategy positions it to capture greater operating leverage and sustain its innovation-led momentum.

Attractive Valuation with Room for Upside

T-Mobile’s valuation remains appealing relative to its history. The stock trades at 9.9x 2026E EV/EBITDA, its lowest level in over a year. Its P/E ratio of 21.3x is below its five-year average of 25.1x, even though it sits above the sector median of 12.8.

This valuation compression provides an attractive entry point given the company’s accelerating fundamentals. The integration of U.S. Cellular, the T-Fiber launch, and continued share gains from rivals could drive upside to consensus estimates over the coming quarters.

Based on my calculations using 14 valuation models — including EV/EBITDA multiples, P/E multiples, and five-year DCF EBITDA exit analysis — I estimate a fair value of $250 per share, implying about 10% upside from current levels.

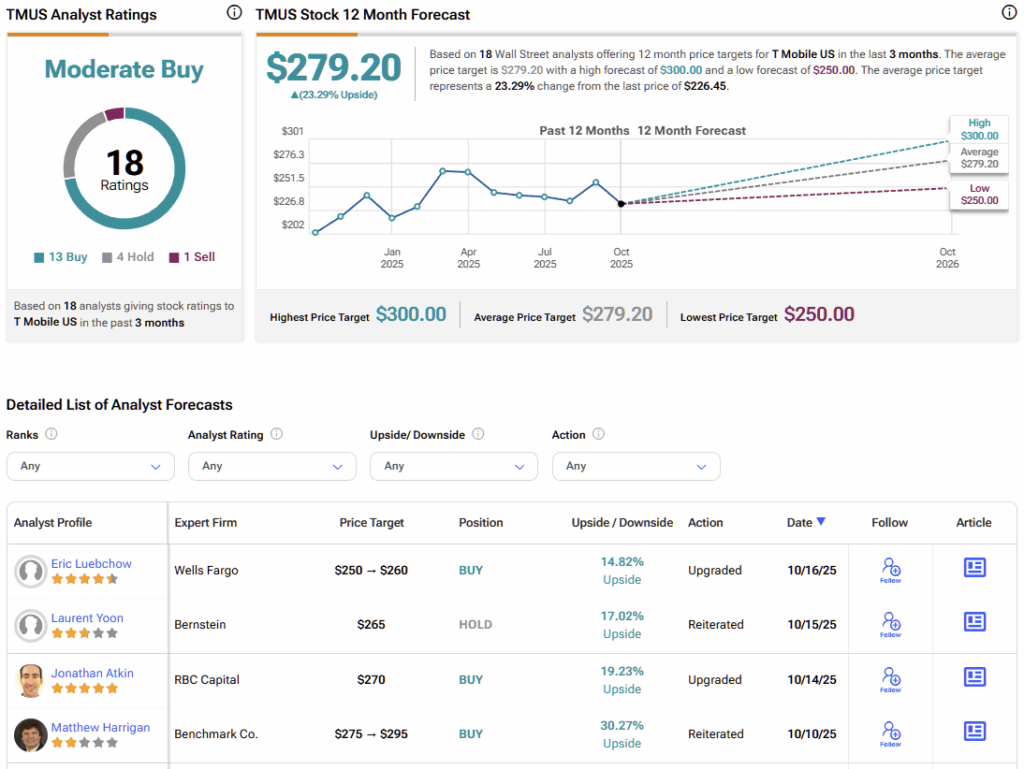

What is the Target Price for TMUS?

According to TipRanks, T-Mobile holds a Moderate Buy consensus rating based on 18 analyst reviews, with 13 Buys, 4 Holds, and 1 Sell. TMUS’s average stock price target is $279.20, implying 23% upside over the next 12 months.

T-Mobile’s Growth Engine Keeps Accelerating

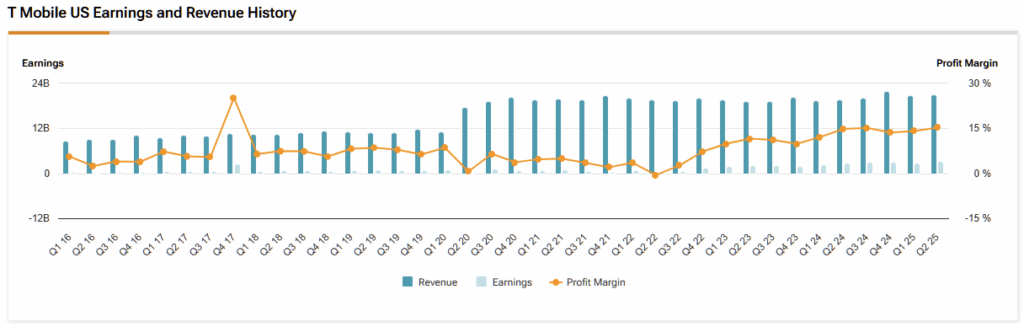

T-Mobile continues to lead the U.S. wireless industry, driven by strong subscriber growth, unmatched 5G coverage, and strategic initiatives that broaden its market reach. The company’s integration of U.S. Cellular, expansion into fiber broadband, and deployment of AI-powered technologies are creating powerful catalysts for sustained revenue and profit growth.

With shares still trading near the lower end of their historical valuation range, I view T-Mobile as offering a compelling risk/reward opportunity for long-term investors.