Telecommunications and wireless network operator T-Mobile US, Inc. (NASDAQ:TMUS) recently revealed its operational results for the fourth quarter and full-year 2021. The strong results can be attributed primarily to a large number of net customer additions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, following the news, shares of the company dropped 1.6% to close at $113.68 in Thursday’s extended trading session.

Operational Details

At the end of the quarter, total net customer additions for the company stood at 1.79 million, which represents a rise of 5.7% from the prior year. Similarly, for the full year 2021, the same metric stood at 5.84 million, up 3.7% from the previous year.

Postpaid net customer additions stood at 1.75 million at the end of the fourth quarter, which denotes an increase of 8.2% from the prior year. Similarly, for the full year, the company reported postpaid net customer additions of 5.49 million, up marginally from the previous year.

However, the company’s prepaid net customer additions for the quarter witnessed a decline of 41.7% from the prior year. Yet, for the full year, the same witnessed a significant year-over-year growth of 135.9% to 342,000 customers.

The company is slated to report its upcoming earnings on February 10, 2022.

Executive Comments

The CEO of T-Mobile, Mike Sievert, said, “It is undeniable that T-Mobile’s unmatched best value, network and experience combination resonates with consumers and businesses when it results in record-setting net adds of 1.2 million postpaid accounts and 5.5 million postpaid customers in 2021, even as we continued to navigate Sprint churn during our accelerated integration. And our 5G leadership continues to be unrivaled on every level. We are crushing our network build out goals. Our nationwide Ultra Capacity 5G and our Extended Range 5G expansion is way ahead of schedule and we aren’t slowing down.

Price Target

Recently, Bernstein analyst Peter Supino reiterated a Buy rating on the stock with a price target of $162, which implies upside potential of 40.2% from current levels.

Consensus among analysts is a Strong Buy based on 12 Buys and 1 Hold. The average T-Mobile price target of $162.85 implies upside potential of 40.9% from current levels. Shares have declined 13.2% over the past year.

Website Traffic

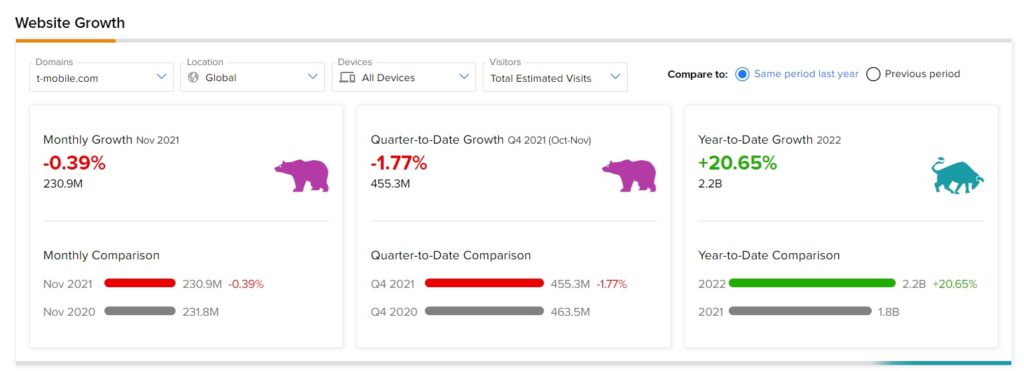

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into T-Mobile’s performance this quarter.

According to the tool, the T-Mobile website recorded a 0.39% monthly fall in global visits in November, compared to the same period last year. Yet, year-to-date, website traffic has grown 20.65%, compared to the previous year.

Download the TipRanks mobile app now.

Related News:

Piper Sandler to Acquire Stamford Partners; Shares Drop 7.2%

MoneyGram Buys Minority Stake in Coinme

Costco Reports Sales Numbers for December