Synopsys, Inc. (NASDAQ: SNPS) has reported impressive results for the second quarter of Fiscal 2022 (ended April 30, 2022). Its earnings surpassed the consensus estimate by 5.5% and revenues exceeded expectations by 1.5%.

Better-than-expected results and healthy projections lifted market sentiments for the stock. Shares of this $41.7-billion software company increased 3.9% in the extended trading session on Wednesday. In the normal trading session, the stock was down 3.6%.

Financial Highlights

Adjusted earnings stood at $2.50 per share in the second quarter, above the consensus estimate of $2.37 per share and the company’s guidance of $2.35-$2.40 per share. On a year-over-year basis, the bottom line surged 47.1% on the back of healthy growth witnessed in its business segments, partially offset by an increase in costs and expenses.

Revenues in the quarter came in at $1.28 billion, above the consensus estimate of $1.26 billion and the company’s projection of $1.24-$1.27 billion. Also, the top line advanced 24.9% from the year-ago tally on the back of an 11.6% increase in revenue from time-based products, 61% rise in upfront products, and 31.5% surge in maintenance and service.

On a segmental basis, Semiconductor & System Design revenues increased 25.4% year-over-year to $1.17 billion and Software Integrity revenues grew 20.2% to $112.9 million.

In the quarter, the total cost of revenues grew 18.1% to $252.8 million and total operating expenses increased 7.6% to $662.7 million. Total segmental operating income increased 48.2% year-over-year to $470.2 million, while the corresponding margin grew 580 basis points to 36.8%.

Balance Sheet and Cash Flow

Exiting the second quarter, Synopsys’ cash and cash equivalents of $1,573.6 million grew 9.8% from the end of Fiscal 2021 (ended October 31, 2021). Long-term debts declined 5.3% to $23.8 million.

In the quarter, the company generated net cash of $905.7 million from its operating activities, up 29.3% year-over-year. Capital expenditure was $67.4 million versus $44.1 million in the year-ago quarter.

Projections

For the third quarter of Fiscal 2022 (ending July 2022), Synopsys anticipates revenues within the $1.21-$1.24 billion range and adjusted earnings of $2.01-$2.06 per share.

For the Fiscal Year 2022 (ending October 31, 2022), the company projects revenues of $5-$5.05 billion, up from the previous projection of $4.775-$4.825 billion. The adjusted earnings per share are predicted to be $8.63-$8.70 per share, higher than the $7.85-$7.92 per share range anticipated earlier.

Management’s Take

Synopsys’ Chairman and CEO, Aart de Geus, said, “Our financial momentum builds on three drivers: an unmatched product portfolio with groundbreaking new innovations, robust semiconductor and electronics market demand, and excellent operational execution.”

Capital Deployment

Synopsys used $109.1 million for making acquisitions in the second quarter, $75.9 million for the repayment of debts, and $500 million to repurchase shares.

Wall Street’s Take

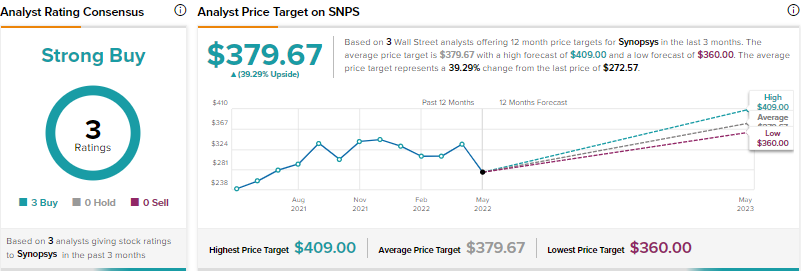

The Street is optimistic about SNPS and has a Strong Buy consensus rating based on three Buys. Synopsys’ price forecast is pegged at $379.67, mirroring 39.29% upside potential from current levels.

Shares of Synopsys have increased 35.2% over the past year.

Bloggers’ Sentiment

The opinions of the financial bloggers tracked by TipRanks are 100% Bullish on SNPS, compared with the sector average of 68%.

Conclusion

According to Aart de Geus, Synopsis has strong growth potential as its customers “continue to prioritize investments to enable the new “smart everything” era. Along with this, the company has capabilities to effectively deal with geopolitical and cost concerns.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

TJX Companies Records Strong Quarterly Revenues; Website Visits Hinted at it

Bath & Body Works Declines 6.2% Despite Upbeat Q1 Results

Marriott Rises on Plans to Monetize Customer Data