Synchrony Financial announced on Dec. 30 that it plans to report its fourth-quarter results on Jan. 29, 2021. Shares of the consumer financial services company rose 1.1% at the close on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Street is expecting Synchrony Financial (SYF) to post Q4 revenue of $2.8 billion implying a year-on-year decline of 9.7%. EPS is expected to decrease by 37.2% to $0.69.

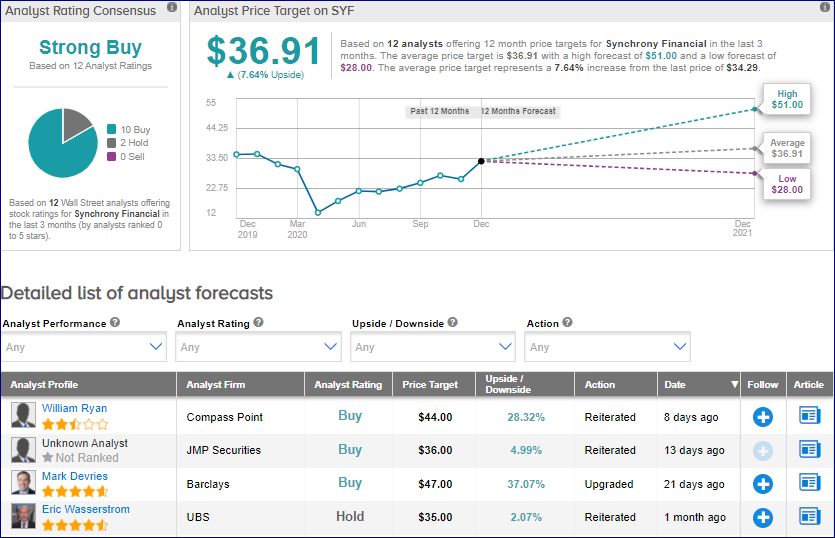

On Dec. 23, Compass Point analyst William Ryan raised the stock’s price target to $44 from $33 and reiterated a Buy rating. The new price target implies 28.3% upside potential.

Ryan raised his 2021 earnings estimate to account for operating metrics that “have clearly been performing better than we had initially expected at the onset of the pandemic.”

Ryan also rolled forward his price target to reflect a valuation based on his 2022 EPS estimate of $4.40. (See SYF stock analysis on TipRanks)

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 10 Buys and 2 Holds. The average analyst price target of $36.91 implies an upside potential of 7.6% to current levels. Shares have lost 4.8% year-to-date.

Related News:

Simon Property Completes $3.4B Taubman Acquisition; Street Says Hold

Regeneron Reports Encouraging Initial Data on COVID-19 Antibody

Intel Urged By Investor Daniel Loeb To Weigh Strategy Changes – Report