Shares of beverage company Constellation Brands (STZ) gained in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2026. Earnings per share came in at $3.63, which beat analysts’ consensus estimate of $3.38 per share. Furthermore, sales decreased by 15% year-over-year, with revenue hitting $2.48 billion. Still, this beat analysts’ expectations of $2.46 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The beer segment, which is STZ’s main revenue driver, as pictured below, saw sales decline by 7% year-over-year, as depletions, which track sales to retailers, declined by 2.7%. This was driven by drops in key brands such as Modelo Especial (down 4%), Corona Extra (down 7%), and Modelo Chelada (down 3%). At the same time, wine and spirits also saw a drop in revenue, with organic net sales falling over 19%, thanks to the divestment of some of its brands. However, depletions increased by 2%.

2026 Outlook

Looking forward, Constellation expects Fiscal Year 2026 earnings to be between $11.30 and $11.60 per share – in line with the $11.44 consensus. It also forecasts $2.5–$2.6 billion in operating cash flow and $1.3–$1.4 billion in free cash flow. Moreover, the company now expects FY26 net sales growth to come in at a range of -6% to -4%.

Is STZ Stock a Good Buy?

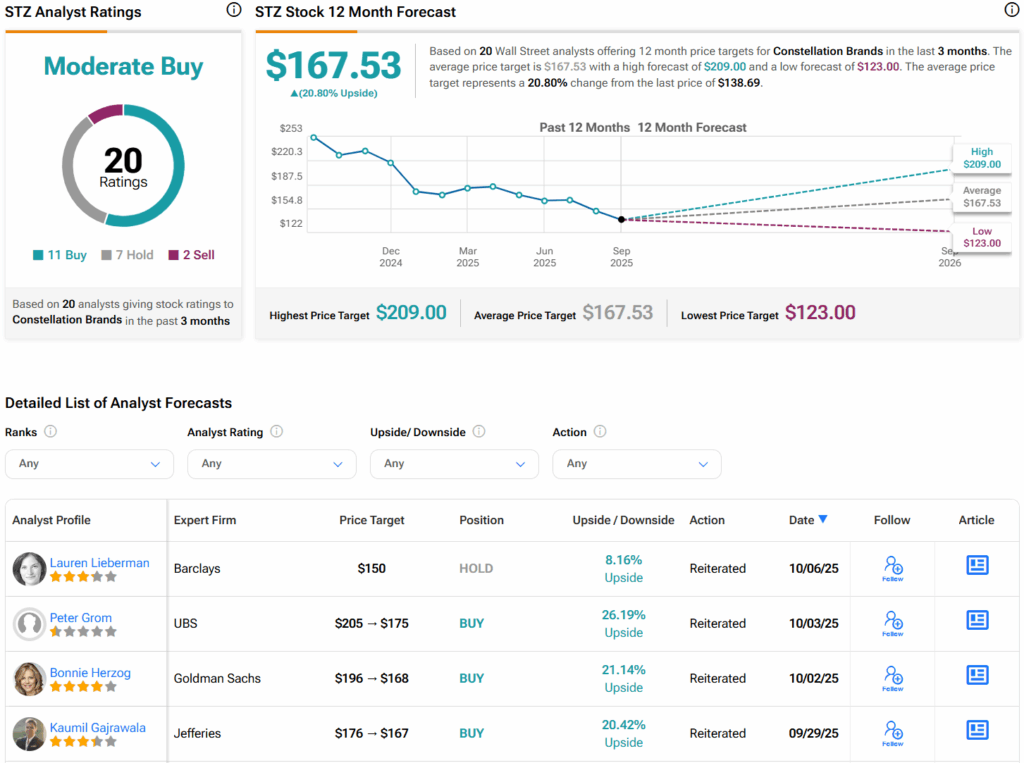

Turning to Wall Street, analysts have a Moderate Buy consensus rating on STZ stock based on 11 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average STZ price target of $167.53 per share implies 20.8% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.