Yesterday, EV maker Tesla (NASDAQ:TSLA) delivered a 56% top-line growth for the third quarter coupled with a significant jump in its bottom line.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nonetheless, amid a plethora of global challenges including rising costs, currency gyrations, and logistics, Wall Street is scaling back price targets for the stock.

Today, a number of analysts including from RBC Capital, Deutsche Bank, Cowen & Co., and Wolfe Research have lowered the price target on the stock. RBC Capital’s Joseph Spak has reiterated a Buy rating on Tesla while decreasing the price target to $325 from $340.

While short-term margin and demand challenges exist, Spak sees the company notching a 30% gross margin in the bigger picture.

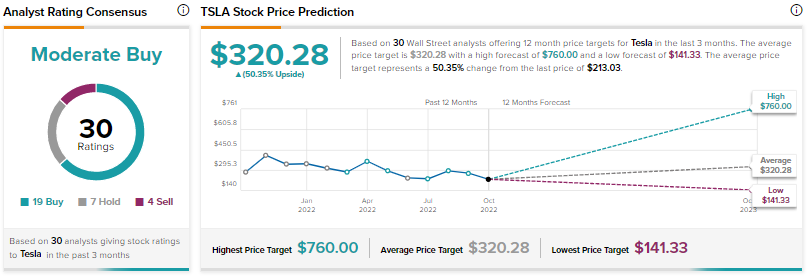

Overall, the Street remains cautiously optimistic about Tesla with a Moderate Buy consensus rating based on 19 Buys, seven Holds, and four Sells.

Further, the average analyst price target of $320.28 still indicates a hefty 50.35% potential upside in the stock.

But that’s after a nearly 47% slide in the share price so far this year.

Read full Disclosure