Tesla (NASDAQ:TSLA) recently reported earnings for its third quarter of Fiscal Year 2022. Adjusted earnings per share came in at $1.05, which beat analysts’ consensus estimate of $1 per TSLA share. In the past nine quarters, the company has beaten estimates eight times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased 56% year-over-year, with revenue hitting $21.454 billion compared to $13.757 billion. Unfortunately, this was lower than the $21.958 billion that analysts were looking for.

In addition, the company demonstrated operating leverage since its operating margin expanded from 14.6% to 17.2% despite the fact that its automotive gross margin decreased from 30.5% a year ago to 27.9% now.

As a result, the company’s operating income grew from $2 billion in the comparable period to $3.7 billion now.

Investor Sentiment for TSLA Stock is Currently Positive

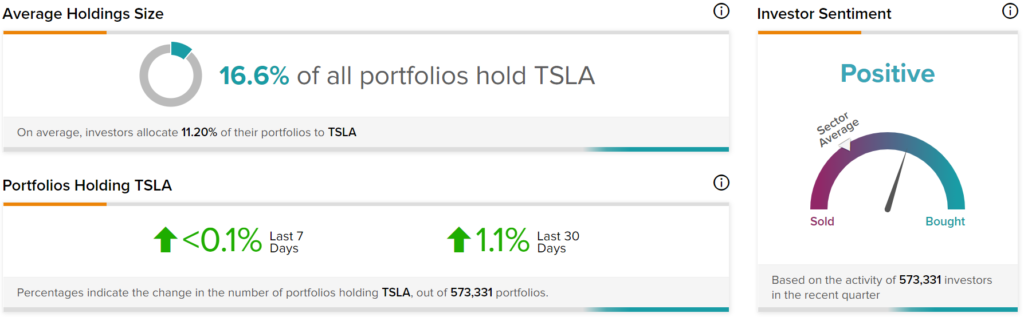

The sentiment among TipRanks investors is currently Positive. Out of the 573,331 portfolios tracked by TipRanks, 16.6% hold TSLA stock. In addition, the average portfolio weighting allocated towards TSLA among those who do have a position is 11.2%. This demonstrates that investors of the company are very confident about its future.

In addition, in the last 30 days, 1.1% of those holding the stock increased their positions. As a result, the stock’s sentiment is way above the sector average, as demonstrated in the following image:

Is Tesla Stock a Buy, Sell, or Hold?

TSLA has a Moderate Buy consensus rating based on 19 Buys, seven Holds, and four Sells assigned in the past three months. The average TSLA stock price target of $325.34 implies 46.2% upside potential.