Both the S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQ) finished in the red following a disappointing trading session. From April 21 to May 2, both indices rose by over 10%.

Today, the Financial Times reported that the US is set to sign a trade deal with the UK this week, providing tariff exemptions on steel and cars. In return, the UK will reduce tariffs on US auto and agricultural imports and provide concessions on its digital services tax for foreign companies. The US shipped over 100,000 vehicles to the UK last year and is the UK’s second-largest export market, said the FT.

The news follows comments made by Treasury Secretary Scott Bessent during an oversight hearing today that a trade deal could be inked this week. President Trump also teased a “very, very big announcement” on his Truth Social account.

Meanwhile, Trump met with Canada’s newly-elected prime minister, Mark Carney. Before the meeting, Trump issued a Truth Social post that questioned why the U.S. subsidizes Canada for “$200 Billion Dollars a year, in addition to giving them FREE military protection, and many other things?” During the meeting, Carney emphasized that Canada was not for sale in response to previous statements from Trump that the country could be the 51st US state. The two sides did not make any progress in regards to a trade deal.

Furthermore, the Atlanta Fed’s GDPNow model released a new estimate for second quarter real GDP growth, providing a forecast of 2.2%. The previous forecast on May 1 was 1.1%, down from 2.4% on April 30.

In terms of earnings, all eyes were on two retail favorites: Hims & Hers Health (HIMS) and Palantir (PLTR). HIMS stock finished the day up by 18%, reversing an earlier 9% fall. The telehealth company reported an 111% jump in revenue, although its guidance was below the consensus analyst estimate.

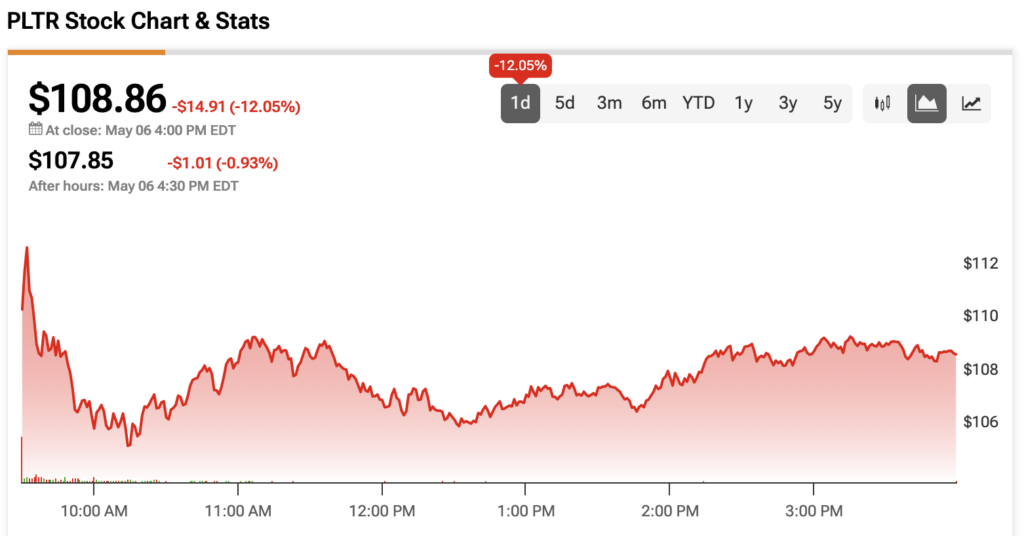

Palantir reported a double beat on revenue and EPS, however, the stock’s generous valuation was the likely culprit in a 12% decline. At the same time, PLTR stock is still up by over 40% year-to-date.