Last Updated 4:05PM EST

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stock indices finished today’s trading session mixed. Indeed, the Nasdaq 100 (NDX) gained 0.08%, while the S&P 500 (SPX) and the Dow Jones Industrial Average (DJIA) fell 0.27% and 0.47%, respectively.

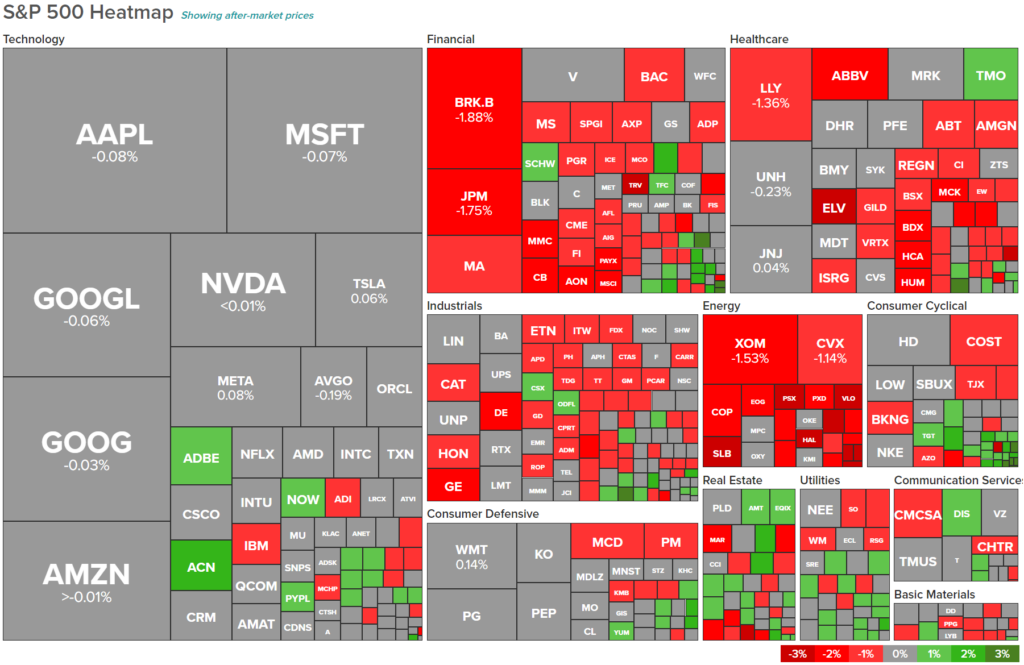

The energy sector (XLE) was the session’s laggard, as it fell 1.98%. Conversely, the consumer discretionary sector (XLY) was the session’s leader, with a gain of 0.53%. However, a quick look at a heatmap for the S&P 500 shows more red and grey than green among the different sectors.

Furthermore, the U.S. 10-Year Treasury yield saw no change as it remains at 4.58%. Similarly, the Two-Year Treasury yield was also not changed, hovering around 5.06%.

Last Updated 1:48PM EST

Stock indices are down so far in today’s trading after the initial boost from today’s inflation report wore off. On Friday, the University of Michigan released its results on consumer inflation expectations over the next five years. Consumers now expect inflation to be 2.8%, which was higher than the expected 2.7% but decreased compared to the previous month.

Taking a look at consumer sentiment, results came in at 68.1, which was higher than the expected 67.7. This is also a decrease compared to last month’s reading of 69.5. However, consumer expectations came in lower than expected. September saw a print of 66 versus the forecast of 66.3, an increase compared to last month’s result of 65.5.

Last Updated 11:20AM EST

Stock indices are in the green so far in today’s trading session as investors cheer today’s softer-than-expected inflation print. However, the United States Chicago Purchasing Managers Index was also released today by ISM-Chicago, which measures the economic health of the manufacturing sector in Chicago. An expansion is defined by a number that is greater than 50, whereas a reading that is lower is considered a contraction.

In September, the number came in at 44.1, which was lower than the expected 47.6 from forecasters and a decrease from last month’s report of 48.7. It’s worth noting that the Chicago PMI has been trending lower since its peak of 75.2 back in May 2021. In addition, this marks the 13th consecutive month that the manufacturing sector in Chicago has contracted.

Last Updated 9:31AM EST

Indices are beginning the last trading day of the month on a cheerful note after the latest inflation print came in at a softer pace in nearly two years. The Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) are up by 0.93%, 0.65%, and 0.45%, respectively, at 9:31 a.m. EST, September 29.

With a rise of 3.9%, the core PCE came in below an annual rate of 4%, its slowest pace in nearly two years. Personal spending growth also slowed to 0.4% from 0.9% in the prior month. Additionally, the U.S. trade deficit in goods dropped by 7.3% to $84.3 billion for the month of August.

First Published 4:30AM EST

The three major stock indices are poised to end the month and the quarter on a negative note. Historically, September has been known to be a sluggish trading month, and this year has been no different. The Fed’s interest rate hike and the possibility of one more rate hike in the year added to traders’ woes. A possible government shutdown has also clouded investors’ minds as the deadline of October 1 soon approaches.

Meanwhile, the Fed’s favorite inflation gauge, the Personal Consumption Expenditures (PCE) index, is due for release today. The index data could add more volatility to the day’s trading. Experts predict core PCE to rise 3.9% year-over-year in August and 0.2% for the month. Also, Personal Income and Consumer Spending reports are due later today.

The initial jobless claims data for the week ending September 23 (reported yesterday) went up by 2,000 to 204,000. Economists had forecast new claims of 215,000, signaling a resilient labor market. Traders certainly hope for a better month (October) and a quarter (December) to end the year with the Q3 earnings season in sight.

In the meantime, WTI crude oil futures retreated from their peak rates and are hovering near $91.60 as of the last check. The U.S. 10-year treasury yields are also down to 4.54%.

Shares of footwear maker Nike (NKE) gained in after-hours trading after exceeding Q1FY24 expectations. Also, Jabil (JBL) stock gained about 19% yesterday following the company’s better-than-expected fiscal fourth-quarter earnings. On the other hand, BlackBerry (BB) shares were shaky after the phone maker reported mixed Q2FY24 results.

Elsewhere, European indices are trading in the green on Friday as traders await the Eurozone’s inflation data. Germany’s preliminary inflation figures showed modest declines, boosting investor confidence.

Asia-Pacific Markets End Higher on Friday

A majority of Asia-Pacific indices finished higher on Friday. Notably, Tokyo’s headline inflation data rose 2.8% in September compared to the prior year, lower than the 2.9% seen in August. Moreover, core inflation (excluding oil and gas) came in lower than expected at 2.5%.

Japan’s Nikkei and Topix indices ended lower by 0.05% and 0.94%, respectively.

On the other hand, Hong Kong’s Hang Seng and China’s Shanghai Composite and Shenzhen Component indices finished up by 2.51%, 0.10%, and 0.05%, respectively.

Unlock all the tools you need to get through the market uncertainty, with 40% off Premium!