Last Updated 4:05 PM EST

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stock indices finished today’s trading session mixed following comments from the Federal Reserve and new economic data (see previous updates). Indeed, the Nasdaq 100 (NDX) and the S&P 500 (SPX) gained 0.24% and 0.02%, respectively. Meanwhile, the Dow Jones Industrial Average (DJIA) fell 0.2%.

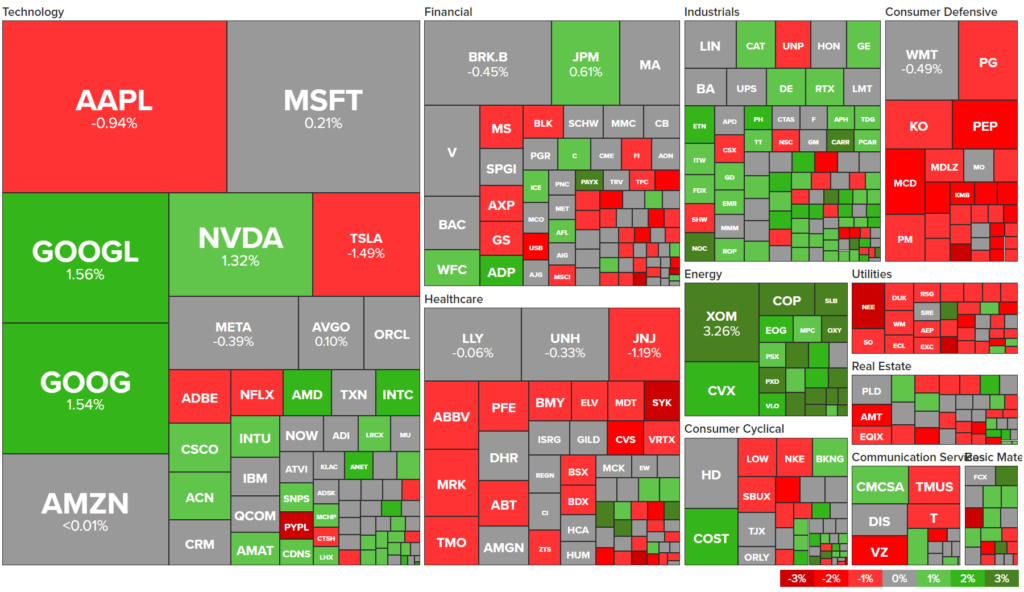

The utilities sector (XLU) was the session’s laggard, as it lost 1.94%. Conversely, the energy sector (XLE) was the session’s leader, with a gain of 2.47%. A quick look at the heatmap for the S&P 500 shows why this was the case, as the energy sector had no stocks in the red. Meanwhile, utilities saw heavy losses.

Furthermore, the U.S. 10-Year Treasury yield increased to 4.61%, an increase of seven basis points. Similarly, the Two-Year Treasury yield also increased, as it hovers around 5.13%.

The Atlanta Federal Reserve updated its latest GDPNow reading, which allows it to estimate GDP growth in real time. The “nowcast” becomes more accurate as more economic data is released throughout the quarter. Currently, it estimates that the economy will expand by about 4.9% in the third quarter.

This is unchanged compared to the previous estimate, which can be attributed to recent releases from the U.S. Census Bureau and the National Association of Realtors.

Last updated: 2:45PM EST

Stock indices are mixed so far in today’s session. J.P. Morgan strategists, in their recent global markets strategy report, anticipate that the Federal Reserve will maintain elevated rates until at least the third quarter of next year, citing a robust economy and persistent inflation that’s expected to linger above target until 2026. The report suggests a precarious balance: while a prolonged high-rate environment might lead to a recession, stopping rate hikes before an inversion of the yield curve might have offered a smoother economic deceleration.

Yet, according to the strategists, we’ve already surpassed that preferable point in the current economic cycle. Consequently, the strategists advocate a more cautious approach, emphasizing the need to stay defensive in investments, especially given uncertain market dynamics.

Zooming out, the broader market’s direction appears intertwined with various global events and trends. The future of equities, for instance, hinges on what precisely sustains these high rates. If innovations in AI lead to a surge in productivity, stocks might benefit; however, should geopolitical shifts become dominant factors, bonds and cash could emerge as safer bets.

Additionally, the team underscored the economic drag of government shutdowns, noting that for every week the U.S. government remains closed, there’s a 0.1% dip in the annualized GDP growth. Historical data points to falling Treasury yields during past shutdowns, but this time might differ due to the current interest rate landscape.

Last updated: 12:45PM EST

Earlier today, Minneapolis Fed President Neel Kashkari suggested that a government shutdown or prolonged auto industry strikes might naturally dampen the economy, making it unnecessary for the Federal Reserve to intervene to ease inflation.

Speaking with CNN, he highlighted the interconnected nature of these events but expressed hope that such scenarios wouldn’t unfold. Conversely, he pointed out that the economy has shown unexpected resilience, and if the Fed’s measures don’t temper it as intended, further rate hikes might be on the horizon.

Kashkari, during a separate conversation on CNBC, shared that he anticipates rates to remain consistent in 2024. He stressed that escalating oil prices alone wouldn’t justify more rate hikes, emphasizing the importance of other economic indicators. This aligns with his earlier essay, where he assigned a 40% chance that the Fed might have to raise rates beyond an additional 25 basis points.

Last updated: 9:30AM EST

Stocks opened higher on Wednesday morning, with the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) up by 0.47%, 0.39%, and 0.31%, respectively, at 9:30 a.m. EST, September 27.

Meanwhile, orders for durable goods went up by 0.2% in August as compared to economists’ forecasts of a decline of 0.5%. However, this rise in durable orders was driven by higher defense spending by the U.S. as it looked at replenishing its military weapons after sending some of its military hardware to Ukraine.

Core orders for durable goods (excluding defense and transportation) jumped by 0.9% in August, while orders for commercial planes dropped by 16%, led by Boeing (BA).

While U.S. stocks have been more or less flat so far this year, an analysis done by FactSet’s John Butters of Wall Street analysts’ projections of individual stocks’ performance over the next 12 months reveals something interesting. This analysis indicates that these projections could see the S&P 500 index go up by 19% from its level on September 21, when the index closed at 4,330. For the S&P 500 to achieve these forecasts, it would have to break the 5,000 level.

First published: 4:19AM EST

U.S. Futures are trending higher on Wednesday after seeing a dismal performance by stock indices yesterday. In the meantime, WTI crude oil futures are also inching higher today, near $91.21 as of the last check. And the U.S. 10-year treasury yields are hovering around 4.50%. Futures on the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) are up by 0.52%, 0.48%, and 0.37%, respectively, at 4:15 a.m. EST, September 27.

New home sales data for August and the consumer confidence index for September came in lower than expected, dragging down overall indices in regular trading on September 26. Both traders and consumers are burdened with the repercussions of higher-for-longer interest rate scenarios and still high inflationary pressures. The Fed’s hawkish stance last week and the possibility of one more rate hike this year are adding pressure to already beaten-down consumer sentiment.

Meanwhile, shares of membership-only retailer Costco Wholesale (COST) fell in after-hours trading yesterday despite exceeding expectations. On the other hand, retailer Target (TGT) has decided to shut down nine stores across four states in the U.S. to battle the rising theft and organized crime challenge.

Further, ChatGPT maker OpenAI is seeking a lofty valuation between $80 and $90 billion in its latest share sale, making it the third most valued private player. The company is selling shares from employees instead of issuing fresh shares. Also, tech stocks remained under pressure yesterday after the Federal Trade Commission (FTC) opened an anti-monopolistic lawsuit against Amazon (AMZN).

Elsewhere, European indices are trading mixed today following the release of gloomy economic data points from across the globe.

Asia-Pacific Markets Mostly End Higher

A majority of Asia-Pacific indices finished higher on Wednesday. China’s industrial profits for the first eight months of 2023 witnessed a lower-than-anticipated decline, pushing up Chinese stocks.

Hong Kong’s Hang Seng index and China’s Shanghai Composite and Shenzhen Component indices ended up by 0.66%, 0.16%, and 0.44%, respectively.

Similarly, Japan’s Nikkei and Topix indices finished higher by 0.18% and 0.32%, respectively.

Interested in more economic insights? Tune in to our LIVE webinar.