STMicroelectronics (STM) has revealed that its GSMA-compliant embedded SIM (eSIM) for Machine-to-Machine (M2M) applications, ST4SIM, will have mass-market availability through an e-distribution network.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares of the leading semiconductor company, with the current market capitalization of around $41 billion, have gained 67% over the past year. (See STMicroelectronics stock charts on TipRanks)

The ST4SIM, certified by GSMA (Global System for Mobile Communications Association), is produced at the company’s GSMA SAS-UP1 authorized sites in Europe and Southeast Asia.

The eSIMs will deliver all the services to help build connections between IoT devices and cellular networks. Markedly, the eSIMs will enable remote management as per the GSMA specification, helping clients to change the connectivity provider without having access to the device.

Furthermore, the eSIMs will have various package options, including industry-standard form-factor and chip-scale packages.

The Marketing Director of Secure Microcontroller Division at STMicroelectronics, Laurent Degauque, said, “With rich built-in features and access to world-class provisioning services, our ST4SIM family delivers a convenient solution for numerous M2M applications.”

Degauque added, “Mass-market availability now lets developers everywhere leverage secure and flexible cellular connectivity in more applications than ever, including independent M2M development, proof-of-concept, and prototype projects.”

Societe Generale analyst Aleksander Peterc recently increased the price target on STMicroelectronics to $63.74 (42% upside potential) and reiterated a Buy rating on the stock.

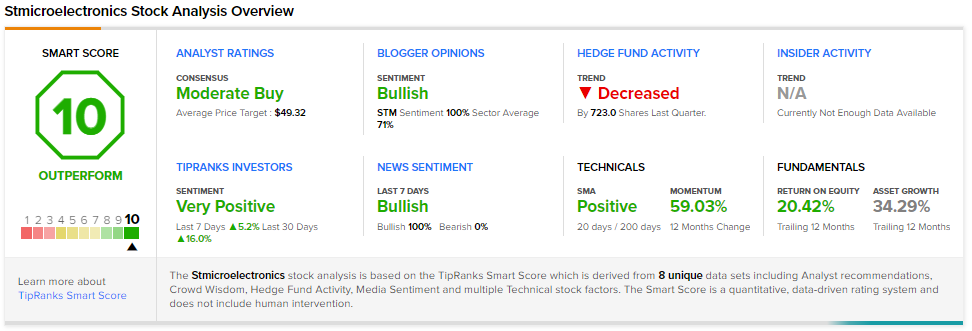

Consensus among analysts is a Moderate Buy based on 5 Buys and 3 Holds. The average STMicroelectronics price target of $49.32 implies 9.9% upside potential.

STM scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Guidewire Delivers Upbeat Q4 Results; Shares Gain 7% After-Hours

American Eagle Digital Sales Decline 5% in Q2; Shares Plunge 10%

Broadcom Posts Q3 Beat and Provides Q4 Revenue Guidance