SoFi Technologies (SOFI) stock has climbed 82% year-to-date, supported by solid financial results and steady growth in its customer base. The digital bank is set to report third-quarter earnings on October 28, with Wall Street expecting earnings of $0.08 per share on $887.24 million in revenue. Ahead of the results, Keefe, Bruyette & Woods (KBW) analyst Tim Switzer raised his price target to $18 from $14, while reaffirming his Sell rating on the stock. Let’s understand why.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyst Sees Short-Term Strength but Flags Valuation Risk

Switzer raised his earnings estimates slightly, keeping his 2025 EPS forecast at $0.32 but lifting his 2025 EBITDA estimate to $998 million from $983 million — higher than both management’s guidance of $960 million and the Street’s consensus. He also raised his 2026 EPS estimate to $0.55 from $0.48, which sits at the low end of management’s $0.55–$0.80 range and is roughly in line with consensus expectations of $0.56.

He also introduced his first 2027 EPS forecast of $0.68, which is slightly below Wall Street’s estimate but still points to about 23% profit growth from 2026.

Cautious on Long-Term Outlook

Despite the near-term strength, Switzer remains cautious on SoFi’s long-term prospects. He said the stock’s high valuation limits its upside, making the risk-to-reward balance less attractive over time.

Switzer noted that while loan growth, cross-selling, and rising deposits could help in the short term, keeping up the same fast pace of growth could be difficult as competition increases and funding costs rise.

Is SOFI Stock a Good Buy?

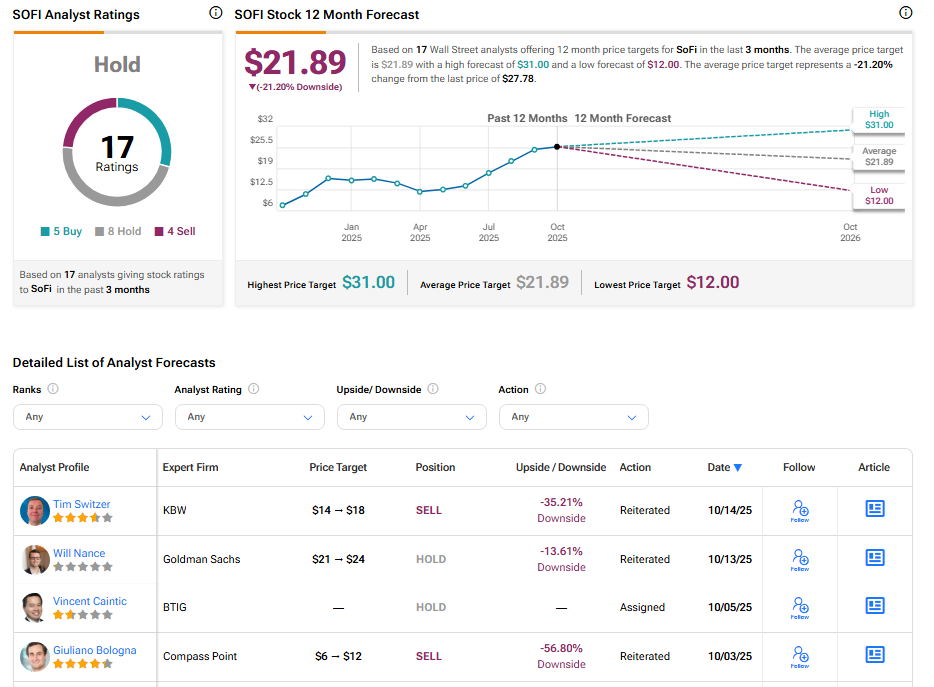

Currently, Wall Street is sidelined on SoFi Technologies stock, with a Hold consensus rating based on five Buys, eight Holds, and four Sell recommendations. The average SOFI stock price target of $21.89 indicates a possible downside of 21.91% from current levels.