Building company Sterling Infrastructure (NASDAQ:STRL) has been at the forefront of the artificial intelligence (AI) tech boom reverberating across the industry, meeting the burgeoning demand for new data centers. Though the stock trades at a premium, recent solid financial results, and a promising future outlook make this a compelling option for growth investors looking for a sneaky way to play the explosive AI-tech sector.

Building AI Data Centers

Sterling Infrastructure is a construction company specializing in heavy civil infrastructure construction, infrastructure rehabilitation, and residential construction. It operates across three major segments: Transportation Solutions, Residential Building Solutions, and E-Infrastructure Solutions.

The AI tech boom has led to a surge in demand for new data centers within the AI-tech sector, translating to significant growth for the company’s E-Infrastructure group, its most substantial and profitable sector.

Most recently, Plateau Excavation, a company subsidiary, has been tapped for a data center project in the southeastern U.S. worth approximately $100 million. The project, covering 280 acres and involving the installment of 125,000 linear feet of underground infrastructure, is set to kick off in the second quarter of 2024. This new development further strengthens the company’s position in the data center construction sector.

Impressive Financials

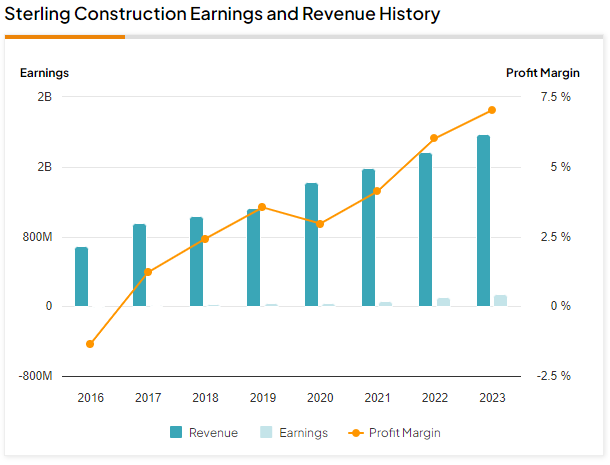

Sterling Infrastructure recently reported strong fourth-quarter results. Revenues for the quarter hit $486 million, marking an 8% increase, while gross margin expanded from 15.4% to 18.9%. The company delivered adjusted diluted EPS of $1.30, which reflected a 94% year-over-year increase and handily surpassed consensus expectations of $1.00.

For the full year of 2023, revenues experienced healthy growth of 11.5% over 2022. Net income for 2023 was a robust $138.7 million, or $4.44 per diluted share, as opposed to $96.7 million, or $3.16 per diluted share in 2022. Adjusted EPS jumped to $4.47 in 2023 from $3.19 last year.

This was the third consecutive year that the company generated adjusted EPS growth of 40% or more, driven by margin expansion and growing returns. The total backlog at year-end was $2.07 billion, up 46% from the prior year, providing strong visibility for another good year in 2024.

STRL Stock’s Valuation and More

Given Sterling Infrastructure’s strong financial results, it should be no surprise that the stock has been trending up over the past year, with the shares climbing around 182%. Shares are trading toward the higher end of the 52-week range of $34.23-$116.36. Ongoing positive price momentum has the shares trading above the 20-day moving average (102.60) and above the 50-day moving average (92.02).

With a healthy price appreciation, the stock now appears richly valued based on comparative metrics. The P/E ratio (24.64x) sits well above the averages for the Industrials sector (18.05x) and the Engineering & Construction industry (18.54x). The P/S ratio exhibits a similar pattern.

Sterling’s Board of Directors authorized a program to repurchase up to $200 million of its outstanding common stock over the next 24 months. This will allow the company to take advantage of any dislocations in the stock price and return capital to shareholders, which might further strengthen the share price.

What is the Price Forecast for STRL in 2024?

While there is not much Street coverage for STRL stock, Sterling Infrastructure is listed as a Hold based on the most recent analyst stock rating in the past three months.

DA Davidson analyst Brent Thielman recently downgraded STRL stock from a Buy rating to a Hold rating, assigning a price target of $115. While he acknowledges that the company’s medium-term market prospects continue to be promising, the downgrade is mainly due to the stock’s recent run-up in price.

Closing Thoughts on STRL

Sterling Infrastructure continues to power forward with solid results and consistent EPS growth, and its extensive backlog signals promising medium-term prospects. However, the stock’s recent rally has it trading at a rich valuation. This may be an intriguing play for growth investors looking for another way to participate in the AI-tech sector boom.