Shares in automaker Stellantis (STLA) reversed nearly 1% today despite shelling out $388 million on beefing up its U.S. manufacturing output.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

U.S. Acceleration

Stellantis, whose brands include Chrysler, Fiat and Alfa Romeo, said it was building a new Metro Detroit Megahub in Michigan. It said that the facility will boast cutting edge technologies and support nearly 500 jobs.

One of the main drivers behind the investment, Stellantis added, was to boost customer service, enhance parts availability and delivery speed across the U.S. market.

It comes at a crucial time for the U.S. car industry which is facing severe pressure from President Trump’s tariffs strategy. This includes hikes on the sector itself but also separate tariffs on key manufacturing hubs such as Mexico and Canada.

Robot Retrievers

As a result U.S. automakers and those from abroad such as Japanese car giant Honda have announced new U.S. manufacturing investments and facilities. This uptick in U.S. manufacturing and the creation of local jobs was one of the key pillars of Trump’s tariffs moves.

There have also been concerns raised by Stellantis and rivals including GM and Ford about the recent U.S. and U.K. trade deal and preferential treatment given to British cars compared with those from North America.

The new Stellantis facility due to open in 2027 will include AutoStore automated storage and retrieval systems , which use robots to retrieve parts and deliver them to workstations.

Is STLA a Good Stock to Buy Now?

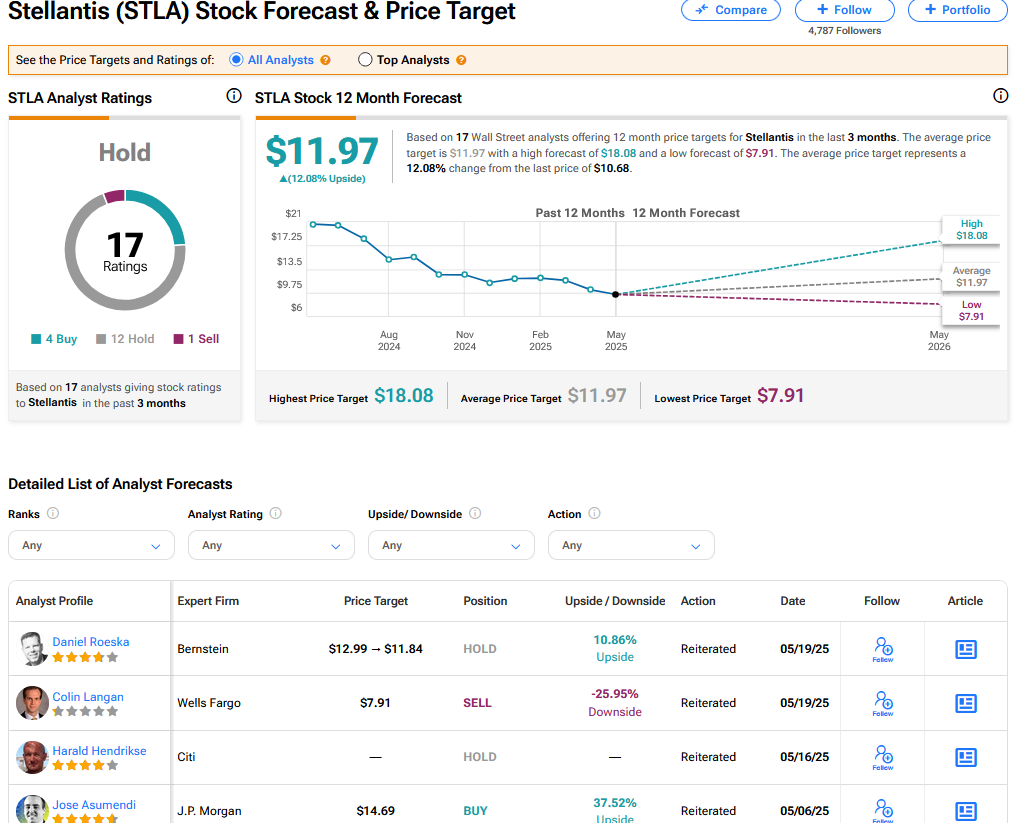

On TipRanks, STLA has a Hold consensus based on 4 Buy, 12 Hold and 1 Sell rating. Its highest price target is $18.08. STLA stock’s consensus price target is $11.97 implying an 12.08% upside.