As legacy automotive giant Stellantis (NYSE:STLA) prepares for its upcoming earnings report (February 15, before market open) for the fourth quarter of Fiscal Year 2023, management finds itself in a potentially positive backdrop. With pure-play EV enterprises suffering from various troubles, Stellantis – which has a foot in both the combustion and electric-powered doors – could make a compelling case for itself. I am bullish on the possible relevance shift toward STLA stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bad News for Pure EVs Could be Good News for STLA Stock

Fundamentally, the good news for STLA stock centers on the bad news that pure-play EV enterprises have incurred recently. Prior to the much-discussed sector price war, seemingly everyone assumed the same thing: electric-powered transportation represents the future of mobility. Further, with political forces pushing the narrative, it appeared that the days of the combustion-powered car were numbered.

However, economic considerations dragged down the EV space as consumers wrestled with high inflation and high interest rates. Lately, extreme winter conditions left many EV owners stranded as they learned the hard way about underperformance in the cold. Further, with inventory pileups imposing a worrying eyesore on the automotive industry, automakers began questioning the aggressive pivot toward electrification.

Not too long ago, Stellantis CEO Carlos Tavares recognized the possibility of another headwind: the contentious election cycle in the U.S. To mitigate the risk, Tavares stated that he had prepared plans for two outcomes. If the Democrats win big, then he’s ready to ramp up EV production. On the flip side, if Republicans take over, Stellantis will slow the EV rollout.

Granted, it’s not surprising that Tavares disclosed this strategy. Because the company has significant strengths in the combustion side of the business and considerable potentialities in the electric end, it would be foolish not to hedge. However, this hedging is also what makes STLA stock so compelling.

Let’s look at pure-play EV enterprises like Tesla (NASDAQ:TSLA) and its ilk. These companies simply don’t have the luxury of offering consumers combustion or hybrid vehicles.

Moving ahead to Stellantis’ upcoming Q4 earnings report, analysts estimate that the company will generate earnings per share of $1.81. That’s a lofty target considering that one year ago, Stellantis produced EPS of $1.53.

Still, STLA stock could win even without an outright earnings beat. If management provides upbeat guidance – especially by aiming to advantage pure-play EV firms’ vulnerabilities – that could be enough to please Wall Street.

Compelling Options Roadmap for Stellantis Speculators

Given the flexibility that Stellantis can leverage – that is, leaning into its combustion arm if outside conditions call for it – the framework for STLA stock appears positive. As an investor, you could decide to just bet on the security itself. However, you could potentially amplify your returns through call options.

For traders who are bullish on STLA stock but want some degree of “safety” – with the understanding that there’s nothing truly safe about options – then they should consider the STLA Mar 15 ’24 23.00 Call. As of the most recent close, this contract was priced at $1.90. What makes it appealing are two attributes.

First, the call is in the money with a strike price of $23. STLA stock recently closed at $24.50, meaning that this contract enjoys intrinsic value as well as some time value (out to March 15). Second, the bid-ask spread is relatively small at 7%.

However, if you’re looking for a cheap option, you probably won’t find a better deal than the STLA Mar 15 ’24 25.00 Call. What makes this call attractive is the price. Today, it closed at 80 cents. So, if you want to buy one contract, you pay 80 cents multiplied by 100 shares, or $80. Moreover, the bid-ask spread comes in at only 6.85%. With an open interest of 583 contracts, the option enjoys attention among the smart money.

Finally, arguably the best holistic deal is the STLA Sep 20 ’24 26.00 Call. While it’s further out the money than the other two calls with a strike of $26 – and thus lacking intrinsic value – it features the most time value because it expires in late September.

So, if you’re feeling not as confident about the bull case and maybe want another earnings report (or two) to digest, then you’d have that time luxury with this September call.

Don’t Ignore the Valuation

It’s almost easy to forget that with the compelling options available, STLA stock also makes a tempting financial case. Specifically, shares trade at a lowly trailing-year earnings multiple of 3.5x. Compare that to the automotive manufacturing sector, which prints a multiple of 18.5x.

And sure, low price-earnings ratios tend to be warning signs rather than buy signals. However, each case must be assessed on its own merits. With STLA stock, we have an underlying enterprise that stands ready to accommodate political and economic forces. Plus, the fact that it has the capability to pivot between combustion and electric-powered vehicles offers credibility.

Is STLA Stock a Buy, According to Analysts?

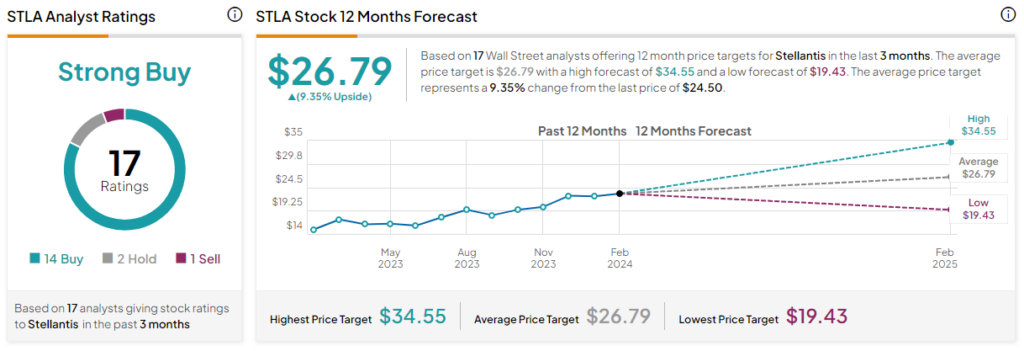

Turning to Wall Street, STLA stock has a Strong Buy consensus rating based on 14 Buys, two Holds, and one Sell rating. The average STLA stock price target is $26.79, implying 9.35% upside potential.

The Takeaway: Flexibility Could be Key to STLA Stock Ahead of Earnings

With the EV sector suffering from numerous woes, including a contentious price war and extreme winter conditions, Stellantis enjoys the flexibility to pivot based on outside circumstances. If management believes that the winds will favor EVs, the automaker can make the adjustment and vice versa. And if you’re bullish and ready to amplify your returns, certain STLA stock call options bring out some attractive deals.