Stocks affiliated with the past year’s hottest trend – AI, of course – have been some of the market’s biggest winners and you can certainly include Palantir (NYSE:PLTR) in this outperforming group. To wit, shares posted gains of 167% in 2023 and have added another 34% year-to-date.

That’s obviously great news for investors but, according to Monness’ Brian White, an analyst ranked in the top 1% of Street stock pros, the stock has reached the point where its valuation is just too hot.

“On the back of this unprecedented generative AI hype cycle, Palantir surged in 2023 and the stock’s upward trajectory has continued in 2024, leaving the company with what we view as an egregiously rich valuation,” White said.

As such, White has now downgraded his Palantir rating from Neutral to Sell, and has set a 12-month price target of $20, suggesting the shares are currently overvalued by 13%. (To watch White’s track record, click here)

Palantir’s supercharged upward trajectory really kicked off with the unveiling of its Artificial Intelligence Platform (AIP) in Q2 last year. Like numerous other enterprise software firms, for years, Palantir has utilized conventional AI, also known as predictive AI. However, following OpenAI’s introduction of ChatGPT in November 2022, the industry’s attention turned towards generative AI. Yet, despite the “unprecedented hype” over this timeframe, White notes that the enterprise software stocks under his coverage generate “de minimis revenue” from generative AI right now and the analyst remains skeptical about that changing much in 2024.

As far as Palantir is concerned, on its Q4 earnings call, the company made positive noises regarding the appetite for AIP although management didn’t provide any details on concrete AIP revenue. Furthermore, White anticipates that enterprises will “be thoughtful” when incorporating generative AI, plus there’s an abundance of next-gen AI solutions currently on offer in the market.

Nevertheless, that hasn’t impeded the shares’ charge, with the gains made “handily outpacing” those of other names White covers. In fact, going by White’s estimates, Palantir boasts not only the “richest valuation” in his enterprise software group, but it also takes top spot across his “entire universe” of coverage. “Moreover,” adds the 5-star analyst, “the number of shares outstanding is excessive, and we believe it will take years for Palantir to grow into its current valuation.”

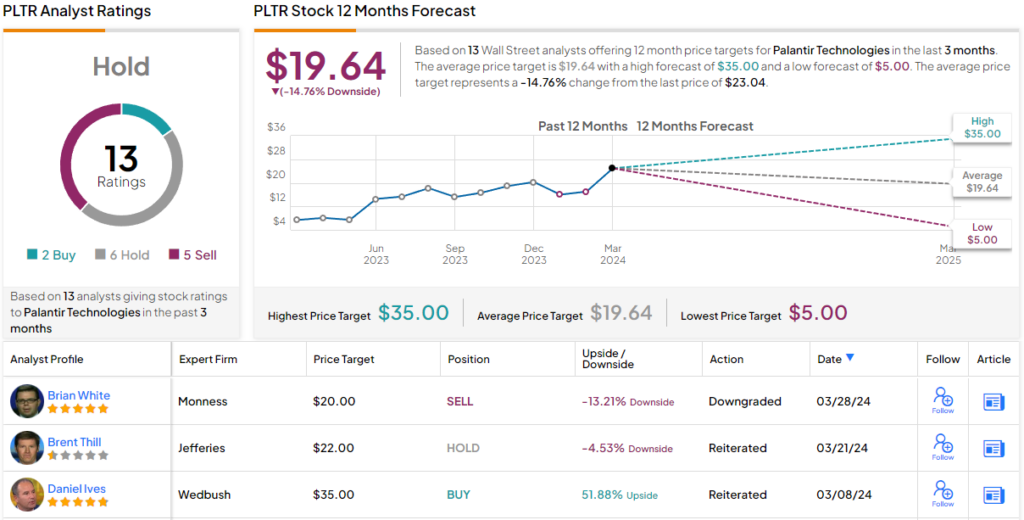

So, that’s the Monness view, what does the rest of the Street have in mind for PLTR? 4 others join White in the bear camp, recommending to Sell, and with the addition of 6 Holds and 2 Buys, the stock claims a Hold consensus rating. The $19.64 average target is slightly lower than White’s objective and factors in downside of 16% in the year ahead. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

.