Being a bull involves anticipating a stock is destined to push higher, but what happens when a bullish prediction has played itself out to perfection? This is the scenario confronting Envision Research, aka Lucas Ma, as he navigates the investment outlook for Advanced Micro Devices (NASDAQ:AMD).

Riding the AI-fueled tech rally of the past year, the stock has been one of the market’s winners, up by 89% over the past 12 months and 23% year-to-date, but now Ma thinks it’s time to change the tune.

“A bull thesis that works tends to eventually defeat itself,” he says. “As prices advance, risks heighten, the potential for further gains shrinks, and the reward/risk profile changes… AMD’s stock price has advanced significantly, leading to heightened risks and limited potential for further gains in the near term.”

It’s not that AMD has suddenly become a bad company and Ma still feels “positive about the stock’s long-term outlook,” but more in the near-term, with the stock price now “far ahead of its fundamentals,” the return potential is “very bleak.”

Ma sees issues on several fronts. For one, in the Data Center segment – the group to which the specialized AI chips belong – competition is too fierce, particularly with Nvidia currently dominating the market and Ma fearing a snowball effect, making it even harder for AMD to gain traction. Ma also thinks AMD’s inventory levels are too high, expecting the costs related to inventory will affect the margin profile. What’s more, the valuation is just too high, with Ma noting that AMD’s current P/Sales ratio is 12.92x, far above its average historical P/Sales ratio of 4.9x (for comparison purposes, the S&P 500’s loftiest ratio since 2006 stood at 3.04x, seen in December 2021). Add into the pot recent instances of insider selling and Ma concludes that “despite the long-term growth prospects (due to factors like high-performance computing expansion and AI adoption), AMD will offer an unattractive return/risk ratio in the near term.” Accordingly, Ma rates the shares as a Hold (i.e., Neutral). (To watch Envision Research’s track record, click here)

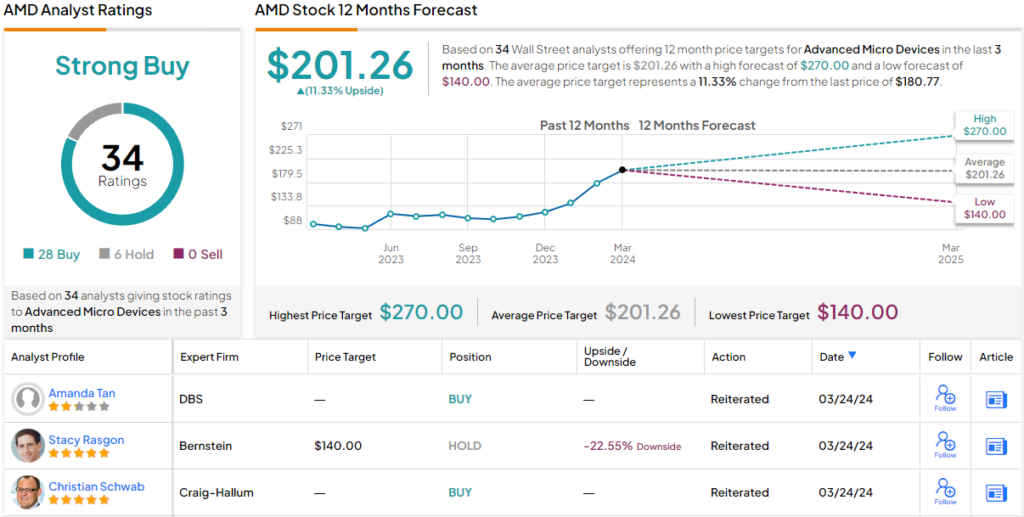

That, however, is not the consensus view on Wall Street. The analysts rate the stock a Strong Buy, based on 28 Buys vs. 6 Holds. Going by the $201.26 average target, a year from now, the shares will be changing hands for ~11% premium. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.