Shares of State Street Corporation (STT) rose 1.3% in Monday’s trading session after the CFO of the American financial services and bank holding company, Eric Aboaf, said that the company expected its Q2 fee-based income to increase in the range of 4-5% from 2-3% anticipated earlier.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Strong performance of equity markets seems to be backing the company’s upbeat expectations. Notably, the S&P 500 Index has rallied about 7.1% so far this quarter. This is likely to result in higher servicing and management fees.

The servicing fee is now expected to grow by 10% year-over-year. Excluding notable items, expenses are anticipated to increase by 3%, majorly due to currency translation. (See State Street stock analysis on TipRanks)

The CEO of State Street Institutional Services, Francisco Aristeguieta, said that the adoption of a more integrated business model had resulted in the strong performance of the company’s new and core businesses.

Last month, Deutsche Bank analyst Brian Bedell reiterated a Buy rating on the stock and raised the price target from $98 to $105. The analyst’s price target implies 23.84% upside potential.

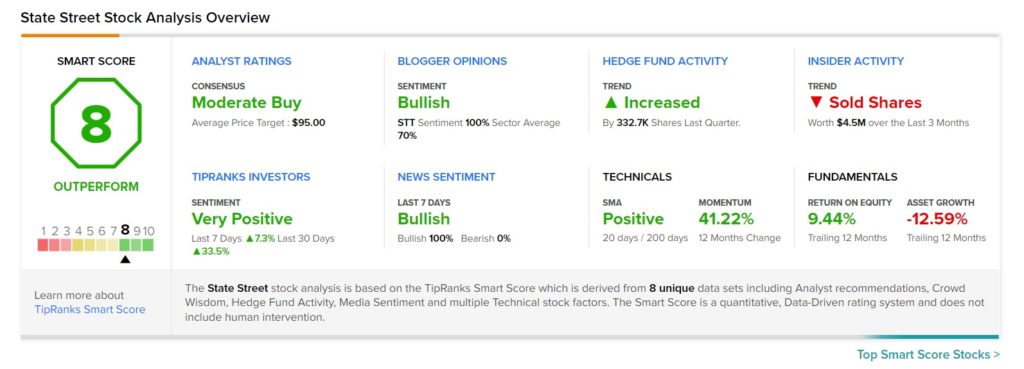

Consensus among analysts is a Moderate Buy based on 4 Buys and 3 Holds. The average analyst State Street price target of $95 implies 12.04% upside potential from current levels. Shares have jumped 4.8% over the past six months.

According to TipRanks’ Smart Score system, State Street gets 8 out of 10, which indicates that the stock has the potential to outperform market expectations.

Related News:

PPL Corp Divests U.K. Utility Business; Plans to Reduce Debt with Proceeds

BlackRock Approved to Start First Wholly Owned Mutual Fund Business in China: Report

California Water Service Arm to Acquire Assets of HOH Utilities Company; Shares Rise 1.7%