Shares of coffeeshop behemoth Starbucks (NASDAQ:SBUX) are down 9% in the last year, as the company has been hit by inflation, the violence unfolding across the Middle East, and increasing competition in China. Still, the Seattle-based chain has solid fundamentals and, despite its already massive global scale, plenty of room for growth.

Investors willing to ride out mixed market sentiment could see lucrative returns. I join several prominent analysts across Wall Street in naming Starbucks as a potential name for investors looking to buy while prices are down.

Global Factors Hindered Business

Like retail companies of all kinds, Starbucks faced challenges due to rampant inflation in recent quarters. Citing rising costs, the company raised prices on many of its products multiple times since 2021. The series of price hikes provoked the anger of some customers, but Starbucks still managed to log sales increases as well.

More recently, Starbucks has wrestled with global unrest and increasing competition. In early March 2024, the Middle East franchisee of the coffee firm announced that it would lay off 2,000 workers in the region, the result of ongoing turmoil in recent months. And in China, Starbucks has been dethroned as the top coffee spot in terms of both sales and units, with local rival Luckin Coffee (OTC:LKNCY) assuming the top spot as of November.

Plans for Massive Expansion

The above factors have weighed on Starbucks shares in the last year, dragging them well below the company’s all-time high of more than $126 per share in the summer of 2021. As of today, SBUX is trading about 28% below that at just under $91 per share. Moving averages across five-, 10-, 20-day, and longer periods have all trended downward.

Nevertheless, Starbucks has strong fundamentals that are not jeopardized by the recent slump in share price. The company generated nearly $35 billion in revenue in the last year and still maintains nearly 39,000 locations around the world. Starbucks’ global reach is tremendous. Yet, the company still has plans to continue to expand and grow its global footprint.

Company management has set a goal of 20,000 U.S. locations someday, an increase of almost 25% from today’s level. In China, the pace of brick-and-mortar growth could be even faster as Starbucks redoubles efforts to claim the majority stake in the market. Starbucks executives have said they aim to have 9,000 locations in the country by the end of Fiscal 2025, a 29% increase over current levels.

Concurrent Fiscal Growth

Starbucks has also demonstrated the potential for continued fiscal growth. In the most recent quarter, which ended on December 31, 2023, Starbucks posted a 5% comparable-store sales increase, beating rivals like McDonald’s (NYSE:MCD). In the last quarter, SBUX’s profit margin increased by a full percentage point to 16% of sales, and earnings climbed by 20% year-over-year.

Helping to drive this growth is the popularity of Starbucks’ rewards program, which has more than 34 million members active in the last 90 days as of the last report. Rewards members drive 59% of all sales at company-owned shops and provide essential data for marketing and product development purposes.

Brand Strength

Above all, Starbucks enjoys immense brand strength across the coffee world. The size and scope of this brand allow Starbucks to charge premium prices on many of its drinks relative to competitors. The firm also leverages its global reach to secure lucrative deals on coffee and other commodities necessary for its operations, giving it a further advantage over smaller rivals.

Is SBUX Stock a Buy, According to Analysts?

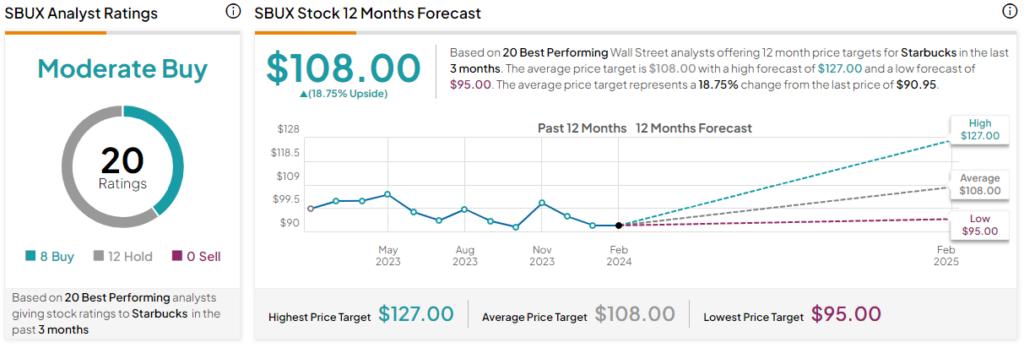

The factors mentioned above have led Wall Street analysts to issue a Moderate Buy rating overall for SBUX. This is based on 26 ratings, including eight Buys, 12 Holds, and zero Sells. The average SBUX stock price target is $108, representing 18.75% upside potential over current levels.

Conclusion: Solid Business and Growth Plans Mean Potential for Investors

Starbucks’ P/E ratio is over 24x, meaning that the stock is not as much of a bargain as some others across industries. However, the sheer weight of the company’s brand, its ambitious growth plans, and its strong history of building sales and margin figures make it a worthwhile stock for consideration, particularly for investors looking to the longer term.