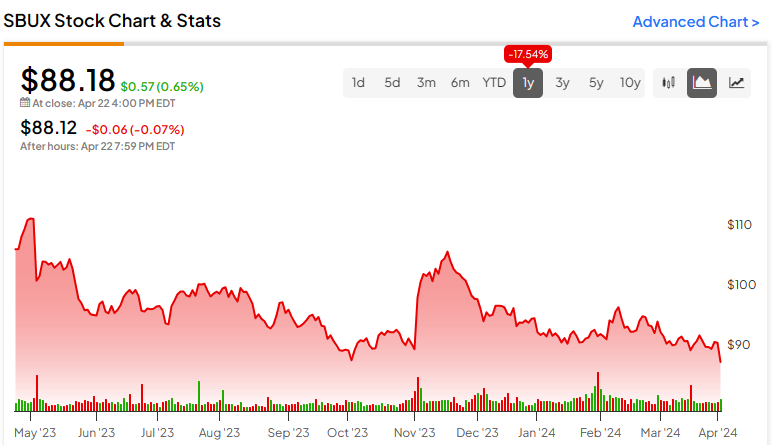

Starbucks (NASDAQ:SBUX) stock has been slowly and steadily sinking since its recovery rally faltered back in April 2023. With numerous headwinds, including high input and labor costs, weighing heavily in recent quarters, it’s been tough sledding for Starbucks as consumers seek to dodge inflation any chance they get. Questions linger as to what could help SBUX stock get hot going into the summer.

Undoubtedly, high coffee bean prices have come at quite an inopportune time for Starbucks, with inflation continuing to hurt consumers’ ability to splurge. California’s big minimum wage hikes ($20.00 per hour) are also untimely, with the firm looking to do its best to make it through one of the worst slate of headwinds in years.

Despite the mounting list of woes, I remain bullish on Starbucks at today’s valuation. At the end of the day, Starbucks is a powerful brand with considerable pricing power, which should help it recover as consumer conditions improve and macroeconomic pressures lessen. Moreover, the company’s innovations are poised to drive sustained cost savings. Plus, there’s still a massive growth runway to be had in China, a depressed economy that’s overdue for a sizeable recovery.

Starbucks Could Stand to Sizzle in Time for Summer

With the summer season quickly approaching, Starbucks will be looking forward to the higher-margin cold drink season. Of course, it’s not just ice-filled beverages that will save Starbucks a few bucks; the firm also stands to receive fewer coffee orders as menus fill with fruitier and tea-based offerings.

An increased thirst for iced beverages may give Starbucks a bit of a break as it looks to do its best to subtly pass prices onto consumers without scaring them away for good. Also, coffee bean prices need a chance to cool off as the company looks to extend the cold drink season well after the chillier autumn months begin.

Despite the potential for a seasonal margin jolt, Starbucks still needs to grapple with high labor costs, especially in select markets where minimum wages are soaring. Just this month, Starbucks raised prices by $0.50 in the state of California in response to recent state-wide minimum wage increases.

Indeed, Starbucks has never been a place to go for a cost-conscious caffeine fix. However, as many inflation-hit consumers remain in cost-cutting mode, it may be tougher to pass elevated expenses onto even its most loyal patrons. Arguably, Starbucks has already raised prices by more than enough over the years. And as powerful as the brand is, there comes a point where even the best brands in the world can no longer jack up prices without losing sales.

Fortunately, Starbucks has already been working on various automation initiatives to improve productivity and offset the impact of rising labor costs.

Starbucks: More Automation Could be the Solution to Labor Pressures

Undoubtedly, Starbucks’ biggest sore spot has been labor. Whether we’re talking unionization or minimum wage hikes, there seem to be no easy solutions past such labor-induced headwinds. Though an entirely automated Starbucks with robot baristas isn’t coming to your local Starbucks anytime soon (at least not to my knowledge), major advancements in automation and AI are on the horizon.

These technologies have the potential to drastically reduce the number of baristas at a single location. Perhaps a small, mall-based location could go from being staffed by four baristas to three. The company’s Clover Vertica brewer, which can drastically reduce preparation times, has been rolling out across select stores. By 2025, the firm expects it to be in all U.S.-based company-operated locations.

With Siren System rapid dispensers (which greatly reduce beverage-making times) and Deep Brew AI tools (Deep Brew is an AI-based platform that personalizes customer experiences, optimizes store operations, and manages inventory) thrown into the equation, the company seems to have a solution for the most time-intensive customizable drinks baristas need to fill.

Undoubtedly, it will take time to roll out such advanced time-saving systems. But as they hit more stores, expect a sustained margin boost to follow as Starbucks looks to maximize the productivity of every barista.

Is SBUX Stock a Buy, According to Analysts?

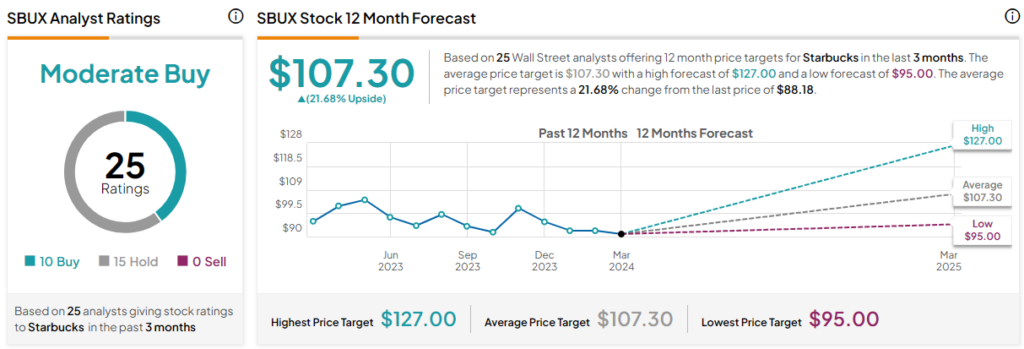

On TipRanks, SBUX stock comes in as a Moderate Buy. Out of 25 analyst ratings, there are 10 Buys and 25 Hold recommendations. The average SBUX stock price target is $107.30, implying upside potential of 21.7%. Analyst price targets range from a low of $95.00 per share to a high of $127.00 per share.

The Bottom Line on Starbucks

Over the long term, Starbucks looks to be on the right track to overcome its recent headwinds. Though the medium term will be weighed by headwinds, I do view them as already baked into the stock at $88 and change. The stock is already down 30% from its 2021 all-time highs.

As the firm looks to welcome back cold drink season while rolling out innovative new menu items and time-saving automation equipment into select stores, I think SBUX stock may just be able to rise in the face of ongoing macro pressures.