As the global economy rebounded from the pandemic slowdown, demand for goods has shot up across industrial and consumer markets. One of the beneficiaries of this phenomenon has been dry bulk shipping companies such as Star Bulk Carriers (NASDAQ:SBLK). A leading company in the dry bulk shipping space, Star Bulk Carriers has enjoyed a dramatic revenue rebound, with share prices appreciating over 150% for the past three years. With a pending merger set to finalize, Star Bulk stands to become the dominant market leader in this industry. The stock could be a strong value play for income-seeking investors.

A Market Leader Getting Bigger

Star Bulk Carriers specializes in dry bulk seaborne transportation. The company operates a diverse fleet of 122 bulk carriers, shipping iron ore, coal, grain, bauxite, fertilizers, and steel products.

A merger with Eagle Bulk Shipping (NYSE:EGLE), slated to be finalized around April 9, will produce the world’s largest publicly listed bulker owner. This new company will have a market cap of approximately $2.1 billion with a fleet of 169 ships.

The outlook for the dry bulk market remains positive, driven by favorable supply dynamics and recovering demand backed by large-scale global infrastructure investments, including significant demand spikes for iron ore, bauxite, and coal. This growth is anticipated to accelerate with the further recovery of the Chinese economy, as its property market stabilizes and consumer confidence rebounds.

Recent Financial Results

Star Bulk recently reported its fourth-quarter financials with revenues of $263.46 million, significantly beating expectations. Meanwhile, earnings per share (EPS) for the quarter were also above market consensus at $0.73.

Star Bulk announced a $0.45 per share quarterly dividend, doubling the previous quarters’ distribution. Since 2021, the company has returned capital to shareholders with $1.1 billion worth of dividend distributions, in addition to executing over $400 million in share buybacks.

Management has given guidance that they see strong market demand continuing in 2024 and 2025. Furthermore, they are taking advantage of this high cash period to transition elements of their fleet to newer, more eco-friendly and efficient ships. The company sold 7 vessels in Q4, for total gross proceeds of $122 million, while taking delivery of 2 new ships.

Is SBLK Stock a Buy, Hold, or Sell?

The stock has been trending upwards, climbing over 14% YTD while continuing to show positive price momentum, trading above the 20-day (23.43) and 50-day (22.35) moving averages.

The company appears to be relatively undervalued on a sector and historical basis. The EV/EBITDA of 7.5x compares favorably to the Industrials sector average of 13.38x, as well as with the company’s average over the past five years of 13.58x.

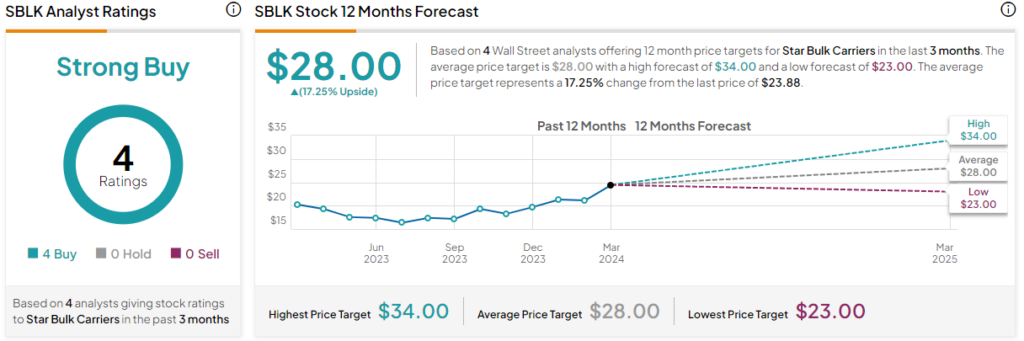

Analysts following the company are bullish on the stock. For instance, Deutsche Bank analyst Amit Mehrotra recently upgraded the price target for the stock from $24 to $34 and reiterated a Buy rating, citing the company’s substantial operational exposure to a significantly growing market.

The stock is rated a Strong Buy based on the ratings and 12-month price targets assigned by four analysts who have published outlooks on the company in the past three months. The average price target for SBLK stock is $28.00, which represents a 17.25% upside from current levels.

SBLK in Summary

Star Bulk Carriers has seen its fortunes rise with the rebounding dry bulk shipping industry. The company is set to consolidate its dominant market position with the successful conclusion of a merger with Eagle Bulk Shipping, as it looks to acquire a larger share of this booming market. The company’s growth potential is compelling, and the stock appears attractively priced for those investors seeking both capital appreciation and passive income.