Digital ad tech firm Trade Desk (TTD) has landed squarely in the penalty box. The stock now trades around $53 — roughly 63% below its 52-week high of $141.53 — a sharp correction for a company that’s still posting impressive growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The selloff intensified after Q2 earnings, as investors focused on softer near-term trends and macroeconomic headwinds, despite underlying growth remaining robust. Yet TTD continues to expand with innovative products and a loyal client base, suggesting plenty of runway ahead. At current levels, the stock appears undervalued relative to its growth prospects — which is why I’m leaning Bullish.

What Really Broke Confidence Post-Q2

The recent sell-off can be attributed to three main factors. First, management’s tone wasn’t amiable on the call, and in follow-up interviews, as CEO Jeff Green flagged tariff-related uncertainty that could pressure large global brands, precisely the kind of advertisers that dominate TTD’s mix. That spooked investors about second-half visibility.

Moreover, guidance for Q3 revenue of “at least” $717 million implied growth decelerating from Q2’s 19% to the mid-teens, which is hardly a collapse but enough to challenge a once-lofty multiple.

Second, the company announced a CFO transition on the same day, which, despite appointing a capable insider (board member Alex Kayyal), created “change-stacking” optics that the market dislikes. Several banks cut ratings or targets, including Bank of America (BAC), which downgraded TTD to Underperform and slashed its target to $49, while Morgan Stanley (MS) and BTIG moved to the sidelines. These quick changes of heart amplified a narrative that TTD had been priced for perfection.

And last but not least, there is a regulatory overhang. Ongoing shifts in Chrome’s privacy approach and broader data-privacy enforcement keep advertisers on edge. Even with Google’s (GOOGL) shifting cookie plans and the UK CMA reevaluating related commitments, the message to marketers is “expect change.” When big brands grow cautious, spend tends to slip to closed platforms first, again a near-term headwind for an open-internet DSP (demand-side platform) like TTD.

TTD’s Growth Remains Robust

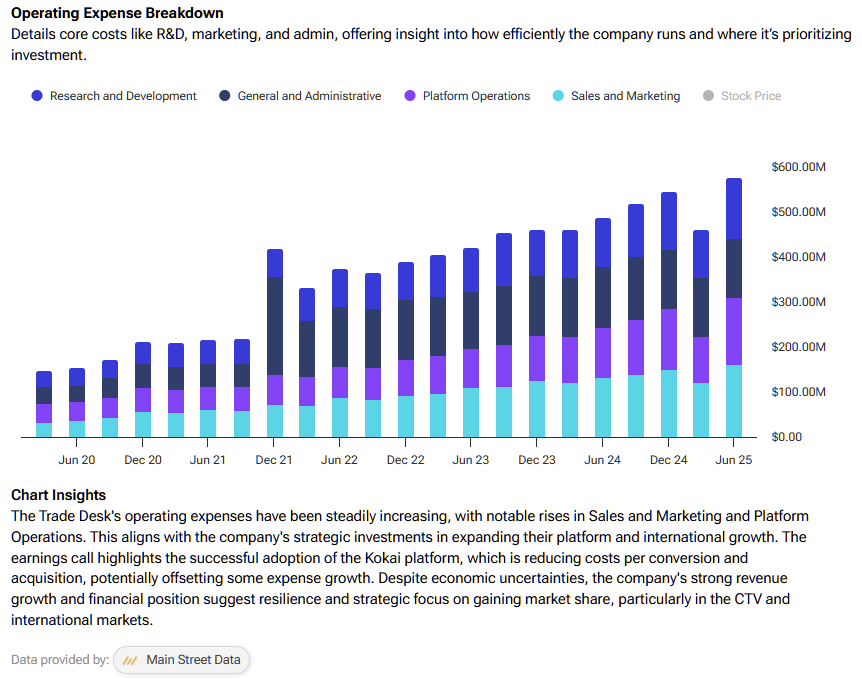

Despite the headlines, TTD’s growth machine continues to grind hard. Q2 revenue grew 19% to $694 million, and customer retention remained above 95%, a streak now spanning 11+ years, while adjusted EBITDA jumped to $271 million (a fat 39% margin). As growth continues, operating expenses are climbing, albeit gradually, according to TipRanks data.

These numbers are not by chance. The company is actually delivering real product progress as Kokai (its AI-driven decisioning layer) is pulling in more first-party data and improving outcomes, while OpenPath is tightening the supply chain (Freestar saw 3x higher fill and a 27% rise in programmatic revenue).

Finally, UID2 integrations continued with AppsFlyer, Bell Media, and Snowflake (SNOW). Partnerships with Instacart, Visa (V), and NIQ enhance retail and payments data, providing valuable signals for brands to track in a cookie-light world.

And momentum hasn’t stopped since Q2. Last week, TTD unveiled Audience Unlimited, a major upgrade to its third-party data marketplace aimed at better performance and cost efficiency for major brands. If you believe the open internet remains a viable alternative to the walled gardens, this kind of tooling is set to make a difference.

Valuation Finally Looks Rational

Interestingly, after the harsh drawdown the stock has undergone, TTD’s forward P/E sits around the high-20s, while consensus still points to rapid EPS expansion in the out-years. The estimates project EPS to step from $1.78 this year to $2.99 in 2028, implying that the forward multiple on those out-year earnings drifts into the high teens, without assuming a heroic re-rating. On a PEG basis, TTD is trading at just 1.4x, hardly a nosebleed multiple given the 18%+ EPS growth per annum expected ahead.

Relative context helps, too. Meta (META) trades at roughly 24.7x forward earnings, while Alphabet trades at 25.0x. These are both mega-caps with consensus EPS growth that’s more mid-teens (and I believe the market underestimates them).

In any case, paying a comparable multiple for TTD, which is an asset-light operator with high gross margins, net cash, and modeled high-teens to ~20% EPS compounding, looks undemanding. Even if the multiple merely stays put, the earnings math alone can carry respectable returns, with any stabilization in macro or execution upside providing optionality for a gentle re-rate.

Is TTD Stock a Good Buy?

On Wall Street, TTD stock features a Moderate Buy consensus rating, based on 15 Buy, 12 Hold, and three Sell ratings. Notably, TTD’s average stock price target of $68.50 implies ~31% upside potential over the next 12 months, suggesting the stock likely remains undervalued following its prolonged sell-off.

TTD’s Selloff Looks Overdone as Core Strengths Set the Stage for a Rebound

All in all, TTD still faces macro headwinds, competitive pressure from major platforms, and ongoing privacy challenges. But markets tend to overshoot both ways — and this latest selloff looks excessive. The company’s core business remains strong, backed by high customer retention, growing exposure to CTV and retail media, and a faster, smarter platform. With the stock down about two-thirds from its peak, expectations reset, and earnings poised to rise, the stage looks set for a sharp rebound.