Financial services and digital payments company Block, Inc. (NYSE: SQ), formerly known as Square, recently revealed that it has joined hands with a UK-based technology start-up incubator, CodeBase, to allow entrepreneurs access to Square’s payment ecosystem and APIs.

Following the news, shares of the company rose 8.7% on Tuesday. The stock, however, pared its gains slightly to close at $102.67 in the extended trading session.

Strategic Impact

With access to Square’s payment ecosystem, CodeBase’s network of startups can benefit from free payment processing, along with discounted hardware, to accept payments. Further, Square will help these early-stage startups with a number of workshops that will allow the entrepreneurs to learn from leaders in the commerce and payments fields.

Additionally, the entrepreneurs will also be able to use Square’s Commerce APIs, Customers and Team APIs and Snippets API to grow and manage each component of their businesses efficiently.

Management Commentary

Developer Product Marketing Manager at Square, Ginevra Mambretti, said, “We are thrilled to be partnering with CodeBase, Scotland’s biggest tech start-up incubator, to provide entrepreneurs with preferential access to Square’s APIs and payment ecosystem. This is a first of its kind partnership in the UK and we are excited to see what’s born from the merging of Square’s tools and CodeBase’s network of innovation.”

Stock Rating

Recently, Mizuho Securities analyst Dan Dolev reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $210 to $180, which implies upside potential of 74.6% from current levels.

Consensus among analysts is a Strong Buy based on 26 Buys and 3 Holds. The average Square price target of $187.29 implies 81.7% upside potential from current levels. Shares have declined 57.6% over the past year.

Website Traffic

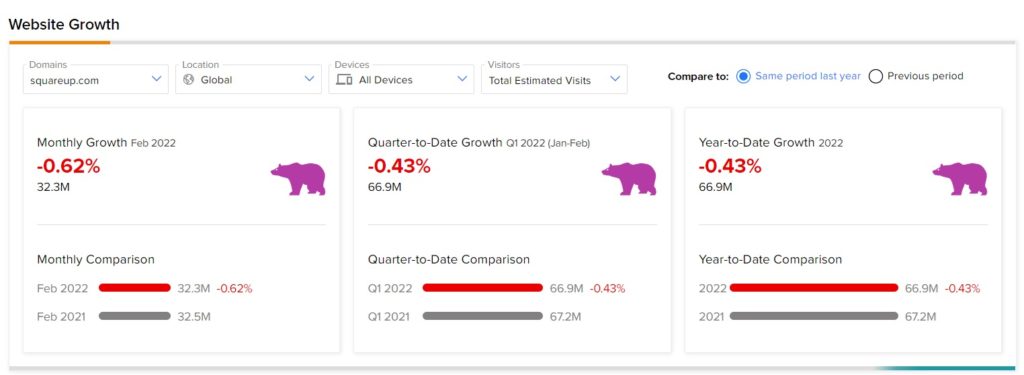

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Square’s performance this quarter.

According to the tool, Square’s website recorded a 0.62% monthly decline in global visits in February, compared to the same period last year. Further, the website traffic has declined 0.43% year-to-date, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Expand EV Footprint in Europe

Blackstone Acquires 49% Stake in One Manhattan West

Curaleaf Opens New Dispensary in Florida; Street Says Buy