The Ford Motor Company (NYSE: F) is taking a stride towards the European market and has unveiled its all-electric future plan for the continent. To start with, the automaker will launch seven, all-electric, fully-connected passenger vehicles and vans by 2024.

It is believed that through its newly created global business unit, Ford Model e, and existing service Ford Pro, Ford will focus on expanding its footprint in Europe. Particularly, the Ford Model e unit is designed to focus on the design, production, and distribution of electric and connected vehicles, while Ford Pro is concentrated on the commercial vehicle business.

Ford is a global automobile company and is the third-largest car manufacturer in the United States. The company is engaged in designing, manufacturing, and selling cars, trucks, and automobile parts. Investors are optimistic about the company’s growth plans and CEO Jim Farley’s aggressive electrification strategy. Shares of the company have risen 20.43% over the past year.

Proactive European Transformation

With the success of the all-electric Mach-E in 2021 and Mach-E GT in 2022 in Europe, combined with the expected launch of the E-Transit in the next quarter, Ford is tempted to introduce more models in the market. Therefore, the recent plan of adding seven all-electric vehicles to the Ford family in Europe includes the launch of three new passenger vehicles and four new commercial vehicles.

Post-launch of new its vehicles, Ford expects annual sales of electric vehicles in Europe to climb over 600,000 units by 2026. Additionally, an EBIT margin of 6% is expected in 2023.

By 2026, Ford expects its European push to help it achieve 2 million vehicles sold worldwide, as well as an EBIT margin of 10%.

The Chairman at Ford of Europe, Stuart Rowley, commented, “These new Ford electric vehicles signal what is nothing less than the total transformation of our brand in Europe – a new generation of zero-emission vehicles, optimized for a connected world, offering our customers truly outstanding user experiences.”

Beginning in 2023, the production of an all-new electric passenger vehicle, a medium-sized crossover, will begin in Cologne, Germany. Additionally, an electric version of Ford’s most popular vehicle in Europe, the Ford Puma, will be available at the beginning of 2024.

The electric Puma will be produced in Romania.

Heavy investments have been put toward producing EVs in Europe, as exemplified by Ford’s $2 billion toward its Cologne plant and a new battery facility.

Complementing the company’s plan of significantly reducing carbon emissions worldwide, Ford targets “zero emissions for all vehicle sales in Europe and carbon neutrality across its European footprint of facilities, logistics, and suppliers by 2035.”

Joint Venture Agreement

To augment its vehicle electrification plans, Ford signed a non-binding Memorandum of Understanding with SK On Co. Ltd. and Koç Holding, to initiate a joint venture business in Turkey. The three partners have the plan of establishing one of the largest EV battery facilities in the country, pending a final agreement.

Wall Street’s Take

Recently, Credit Suisse analyst Dan Levy maintained a Buy rating and a price target of $25 (58.83% upside potential) on Ford.

The rest of the Street is cautiously optimistic about the stock, resulting in a Moderate Buy consensus rating based on eight Buys, six Holds, and two Sells. The average Ford price target of $23 implies 46.12% upside potential. Shares have gained 20.43% over the past year.

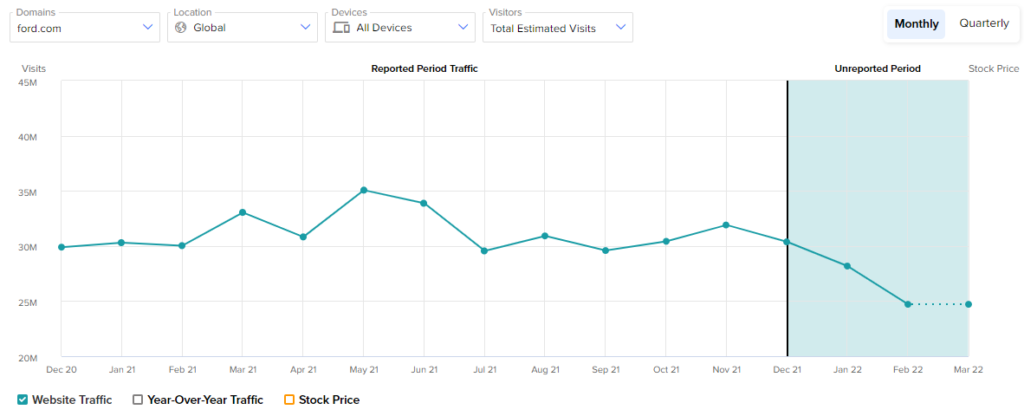

Estimated Monthly Visits

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), offers insight into Ford’s performance.

According to the tool, the automaker’s website recorded 7.23% and 12.31% decreases in global estimated visits in January and February, respectively, on a sequential basis. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at a decline of 12.34%. This, in turn, indicates that the company’s revenues and profitability might disappoint going forward.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FDA Approves AstraZeneca and Merck’s LYNPARZA

Blink Drops Over 5% on Larger-than-Expected Quarterly Loss

Pending WarnerMedia-Discovery Deal, AT&T Outlines Future Growth Strategy