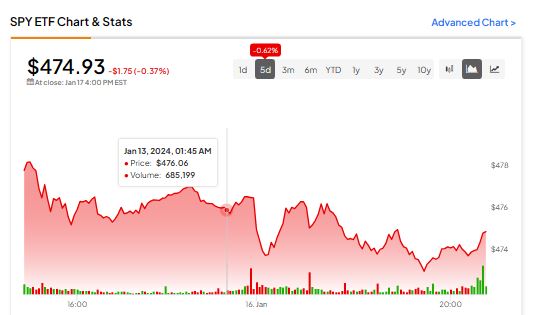

How is SPY stock faring? The SPDR S&P 500 ETF Trust is down 0.62% in the past 5 days but has risen 22% over the past year.

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of its holdings’ analyst ratings, SPY is a Moderate Buy. The Street’s average price target of $521.07 implies an upside of 9.7%.

Currently, SPY’s five holdings with the highest upside potential are Bio-Rad Laboratories (BIO), Bunge Limited (BG), Warner Bros (WBD), United Airlines (UAL), and First Solar (FSLR). Its five holdings with the greatest downside potential are Expeditors International (EXPD), Robert Half International (RHI), Viatris (VTRS), T Rowe Price (TROW), and Tyson Foods (TSN).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.