The SPDR S&P 500 ETF Trust (SPY) rallied 1.18% on Monday. Importantly, the ETF hit a new all-time high of $685.54 during the day. The upside was driven by big gains in tech stocks such as Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), and a strong 11% jump in Qualcomm (QCOM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Within SPY’s holdings, Technology, Communication Services, and Consumer Discretionary sectors posted gains today, while the Materials and Consumer Staples sectors declined.

Importantly, SPY closely tracks the S&P 500 Index (SPX), which also ended 0.8% higher. Further, the Nasdaq 100 (NDX) gained 1.83%.

What Impacted the Market Today?

On Monday, tech stocks climbed after Qualcomm disclosed plans to enter the AI accelerator market, raising investor optimism about future growth in advanced computing. Also, positive market sentiment can be attributed to a lower-than-expected Consumer Price Index (CPI) report, released last week, which raised hopes for potential Federal Reserve interest rate cuts.

Historically, the end of October often sees an upward trend in stock prices. This is due to institutional investors buying stocks with excess cash as they close their fiscal year.

Looking ahead, the Fed interest rate decision on October 29, the ongoing U.S. government shutdown, and earnings reports from five “Magnificent Seven” companies later this week, could trigger volatility in the SPY ETF.

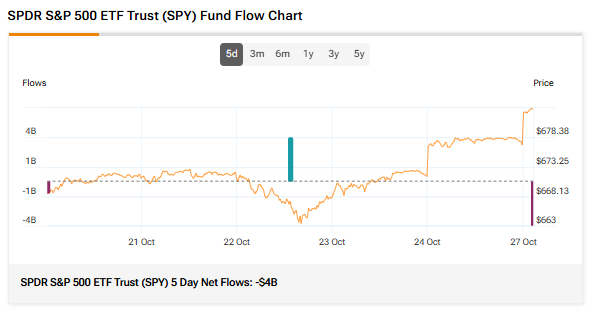

Fund Flows and Sentiment

SPY’s 5-day net outflows totaled $4 billion, showing that investors pulled capital from SPY over the past five trading days. Meanwhile, its three-month average trading volume is 74.02 million shares.

It must be noted that retail sentiment remains neutral, while hedge fund managers increased their holdings of the SPY ETF in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $757.74 for the SPY ETF implies an upside potential of 10.58%.

Currently, SPY’s five holdings with the highest upside potential are Moderna (MRNA), GoDaddy (GDDY), News Corporation (NWSA), Charter Communications (CHTR), and MGM Resorts (MGM).

Meanwhile, its five holdings with the greatest downside potential are Paramount Skydance (PSKY), Palantir (PLTR), Tesla (TSLA), Super Micro Computer (SMCI) and Intel (INTC).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.