Spotify (NYSE:SPOT) stock has been on a parabolic melt-up since bottoming out in the final quarter of 2022. With the music streaming platform’s plans to hike prices (sigh, yes, once again), my guess is that customers will be more than willing to pay as the firm continues to invest in intriguing new innovations that could help tilt the tables in audio streaming ever so slightly in its favor.

Though Apple (NASDAQ:AAPL) Music will always have the pricing edge (think savings generated from the bundling of Apple’s services) and the superior convenience factor (if you’re in the Apple ecosystem, you may as well go for Apple Music over Spotify), Spotify may just have innovation on its side, at least for the time being.

Indeed, complaining about a rival’s dominance can only take you so far. Sooner or later, some degree of innovation has to happen. Fortunately, Spotify’s on the right track, especially when it comes to AI, which may be the key differentiating factor (other than exclusive podcasts) to beckon new subscribers and get the current ones to open up their wallets a bit further.

All things considered, I like what the audio streamer is doing to enhance the customer experience, specifically its work with AI. I view this as vital to its success as it looks to stay on its toes against Apple. For this reason, I’m staying bullish on SPOT stock heading into the summer months.

Spotify’s Pricing Power to Emerge with New AI Features

Undoubtedly, betting big on the AI revolution is the formula to success for many companies, regardless of industry. For Spotify, AI may just be that key driver of shares from here as they look to run head-on with all-time highs not seen since early 2021. With intriguing remixing tools that help users edit and remix music, Spotify may just be allowing its users to take the “mixtape” personalization factor to another level.

As long as these compelling features keep coming, consumers will probably be more than willing to pay a few more dollars per month. At the end of the day, firms need to add value to the table if they’re going to raise prices without facing too much backlash.

These days, people are just so sick and tired of inflation and the endless price hikes from a wide range of firms. From McDonald’s (NYSE:MCD) Big Mac meals to those numerous video streaming services, our wallets are feeling the pinch, and, for some, cuts and churn (in the case of streamers) are the solution.

Spotify isn’t one of the easily churnable services, though, especially since it’s typically the one audio subscription that adds an immense amount of value for the price. And with new innovations thrown in, it adds even more value to the table.

A recent article published by the Wall Street Journal went into depth on how Spotify’s remixing tools could be popular among young people, specifically those who spend a lot of their time on TikTok. I couldn’t agree more. What entices me most about Spotify’s easy-to-use remixing tools is their potential to go viral on various social media platforms, specifically short-form video platforms.

Spotify is reportedly poised to introduce a new ultra-premium (so-called Supremium) tier that may place some of its features behind a higher paywall.

Could a New Subscription Tier be a Hit?

Undoubtedly, I think such an ultra-premium tier could be a massive hit, especially among influencers, creatives, and young people within the Millennial, Gen Z, and even Gen Alpha cohorts. And maybe, just maybe, it could push some Apple Music subscribers to consider pausing their subscriptions to give Spotify a go, at least until Apple offers similar (or better) features of its own.

For everybody else, there’s the regular tier with all the basics and perhaps enough less-complex remixing features to get people interested in testing out a potentially pricier, more advanced tier. Indeed, it will be interesting to see just how much that “personalization” factor comes into play as more Spotify remixes are unleashed to the world.

In any case, I view Spotify’s managers as incredibly smart for tapping into the personalization trend. Add a bit of generative AI magic into the equation — think AI-powered DJs (which were rolled out last year), AI-driven podcast translations (also added last year), and more — and I think more investors should view Spotify as an AI company that just happens to stream audio.

Is SPOT Stock a Buy, According to Analysts?

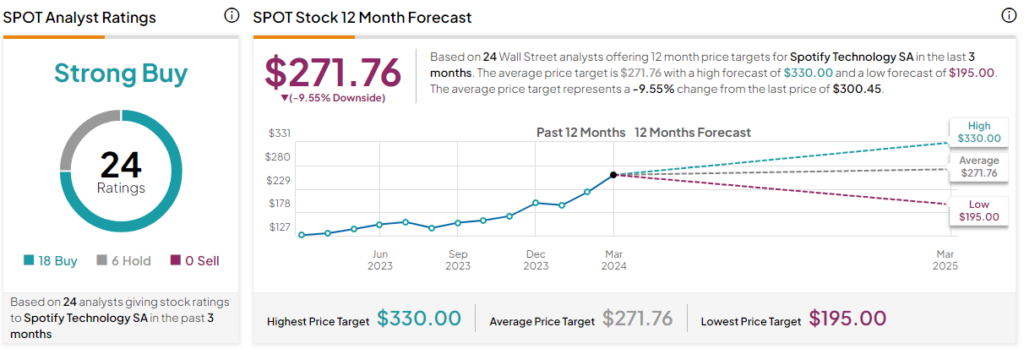

On TipRanks, SPOT stock comes in as a Strong Buy. Out of 24 analyst ratings, there are 18 Buys and six Hold recommendations. The average SPOT stock price target is $271.76, implying downside potential of 9.6%. Analyst price targets range from a low of $195.00 per share to a high of $330.00 per share.

The Bottom Line on Spotify Stock

Spotify is continuing to innovate. And as long as it does, it may be able to take market share and keep its stocks moving higher, all the way to new highs. It’ll be interesting to see how the new subscription tier fares among the creatives out there. My guess is that it could pave the way for a potential upside surprise at some point in the near future.