The race for the approval of the first spot Bitcoin (BTC-USD) exchange traded fund (ETF) is heating up, with the U.S. Securities and Exchange Commission (SEC) accepting applications from six firms, including BlackRock (NYSE:BLK), Reuters reported. The filling of an application for a spot Bitcoin ETF by BlackRock last month sparked optimism in the crypto market and triggered additional applications by other players.

Progress Toward the First Spot Bitcoin ETF in the U.S.

Last week, the SEC accepted the applications from Bitwise and BlackRock. Overall, the spot Bitcoin ETF applications accepted by the SEC include Bitwise’s Bitcoin ETP Trust, BlackRock’s iShares Bitcoin Trust, Fidelity’s Wise Origin Bitcoin Trust, WisdomTree Bitcoin Trust, VanEck Bitcoin Strategy ETF, and Invesco Galaxy Bitcoin ETF.

The SEC recently published documents that urged public comments on Bitcoin ETF proposals, including their potential impact on the market and other aspects. The comment period will span 21 days from the date of the filing in the Federal Register. Following the comment period, the SEC will review the ETF proposal and may seek additional information before arriving at a decision to accept or reject it.

From the time the applications are published in the Federal Register, the SEC will have an initial period of 45 days to reach a decision, though the regulatory body will have the option of extending the review process for up to 240 days to finally approve or deny an application.

While Bitcoin futures ETFs made it to the market beginning in 2021, the SEC has previously rejected several spot Bitcoin ETF proposals. Spot Bitcoin ETFs track the price of Bitcoin, while futures-based ETFs track the price of Bitcoin futures contracts. The SEC previously rejected multiple applications for the spot Bitcoin ETFs for not meeting anti-fraud and investor protection standards.

Despite the increasing regulatory crackdown on the crypto market, the interest of a credible and large company like BlackRock in a spot Bitcoin ETF has fueled hopes of the SEC approving this category of ETFs. BlackRock, which first applied for the spot Bitcoin ETF on June 15, resubmitted the application to include a surveillance-sharing agreement with crypto exchange Coinbase Global (NASDAQ:COIN).

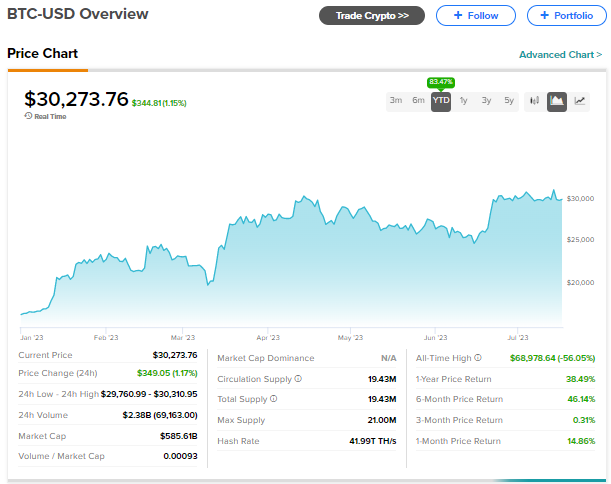

Meanwhile, BTC-USD, the largest cryptocurrency by market cap, has rallied over 83% year-to-date.