While Warner Bros. Discovery (NASDAQ:WBD) was having a bit of trouble establishing itself as a name in sports—despite recently giving a name to a streaming sports offshoot—the latest word suggests that it may be making a comeback. However, this comeback was insufficient for investors, who sent Warner shares down almost 4% in the closing minutes of Thursday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Warner struck a deal with ESPN (NYSE:DIS) to put two first-round College Football Playoff games on TNT, one of Warner’s linear cable networks. Next year, Warner will also get two first-round games in that vein. That plan will continue into 2026, when Warner will get two quarterfinals games thrown in.

But it won’t just be on cable; Warner plans to put the games onto its Max streaming platform, a move reminiscent of Netflix’s (NASDAQ:NFLX) plans for adding sports to its streaming lineup.

Not Giving Up the NBA

Meanwhile, Warner isn’t giving up its pursuit of NBA rights. It’s held these for quite some time, but it’s also seeing significant challenges for them. Its only real saving grace at this point is that it has the right to match any other offer made and so the rights in question are basically its rights to lose.

Reports suggest that Warner may be planning to match an offer that Amazon (NASDAQ:AMZN) made, not an offer that NBCUniversal (NASDAQ:CMCSA) made. Amazon’s package was for a group of games, including the WNBA and first-round playoff games, among others. It was also priced significantly lower than NBCUniversal’s package.

Is WBD Stock a Good Stock to Buy?

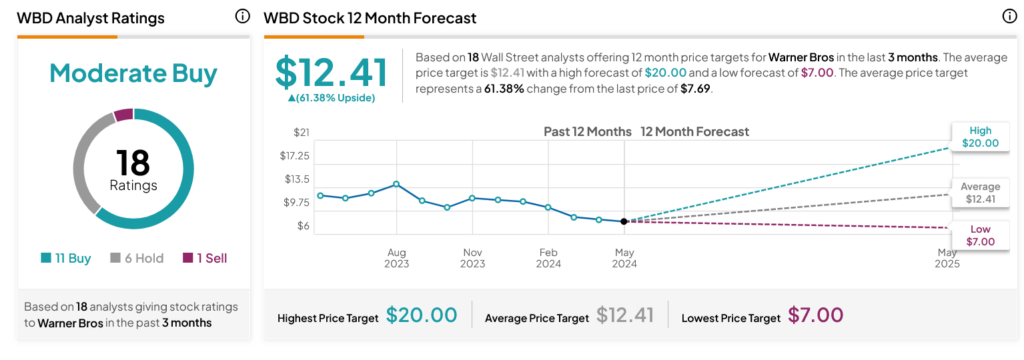

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on 11 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 33.62% loss in its share price over the past year, the average WBD price target of $12.41 per share implies 61.38% upside potential.

Is It Wise to Allocate $1,000 Toward WBD Stock Right Now?

Before you hurry to invest in WBD, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and WBD is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

Discover Top Picks ➜