Ultra-low-cost carrier Spirit Airlines (NYSE:SAVE) stock fell 11.1% on October 30, reflecting investors’ growing concerns about the fading likelihood of a merger. The U.S. Department of Justice (DOJ) is set to begin the trial aimed at preventing Spirit’s merger with JetBlue Airways (NASDAQ:JBLU) today. Investors had hoped for an amicable settlement with the DOJ before the trial could begin, paving the way for a smooth merger. Shares of both Spirit and JetBlue hit fresh all-time lows in intraday trading yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The DOJ is blocking the deal for its anti-competitive nature, citing that the merger of two discount carriers would limit customers’ options while also making the carriers expensive. The regulator was originally set to go on trial on October 16, but the proceedings have been delayed several times. As a result, investors had hoped that things would go in the airlines’ favor, allowing the merger to proceed. Investors will closely watch as the trial begins in Boston today, deciding the fate of both airlines.

Is Spirit Airlines Stock a Good Buy?

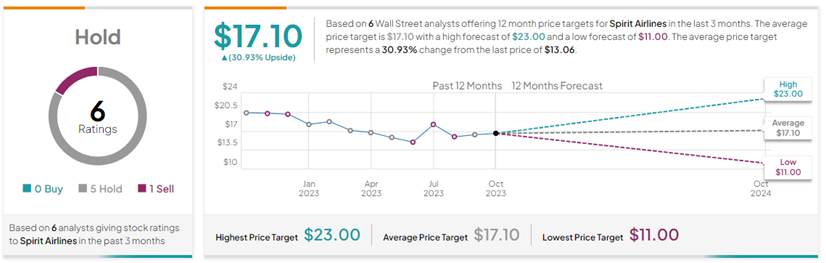

Wall Street has a Hold consensus rating on SAVE stock until regulators decide the fate of the airline. This is based on five Holds and one Sell rating received on TipRanks during the past three months. Further, the average Spirit Airlines price forecast of $17.10 implies 30.9% upside potential from current levels. SAVE stock has lost 28.5% so far this year.