Shares of Spirit Airlines (NYSE:SAVE) fell 5.8% yesterday, as a report by the Dealreporter revealed that the Department of Justice (DOJ) is planning to move ahead with its trial to stop the JetBlue Airways (NASDAQ:JBLU) deal. Meanwhile, JBLU stock hit its 52-week low of $4.57 on the news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last year, JetBlue agreed to buy ultra-low-cost carrier Spirit Airlines for $3.8 billion. However, the deal has been facing regulatory scrutiny owing to its monopolistic nature. The DOJ believes the combination of the two low-cost carriers will thwart competition and decrease the options for customers. The DOJ is scheduled to go on trial with JetBlue on October 16 on the merger matter.

JetBlue’s Efforts to Win Regulatory Approval

In a bid to win regulatory approval, last week, JetBlue announced the divestiture of all of Spirit Airlines holdings at Boston and Newark airports to Allegiant Travel (NASDAQ:ALGT). Moreover, it will hand over five gates and ground facilities at Fort Lauderdale’s airport “to promote ultra-low-cost carrier growth.” Earlier in June, JetBlue had also committed to divesting all of SAVE’s holdings at New York’s LaGuardia Airport to Frontier Group (NASDAQ:ULCC), another low-cost carrier in the U.S. The airline said that these actions were contingent on the successful closing of the merger.

Further, in July, JetBlue abandoned its Northeast Alliance (NEA) with American Airlines (NASDAQ:AAL) after a court ruling ordered them to terminate the deal, citing its anti-competitive nature. Even so, the DOJ does not believe that these divestiture plans are enough to give a green light to the merger. Instead, the regulatory body thinks the merger is not “fixable,” as per the Dealreporter report.

Is Spirit Airlines a Good Stock to Buy Now?

On September 13, Spirit slashed its Q3 2023 revenue forecast, citing rising fuel prices and increased promotional activity. The carrier also widened its negative adjusted operating margin guidance.

Following this, Evercore ISI analyst Duane Pfennigwerth cut the price target on SAVE to $20 (32.8% upside) from $25 while maintaining his Hold rating. The analyst adjusted his model forecasts for his entire airline coverage based on higher fuel price expectations in Q3 and beyond. He expects Frontier and Spirit to face the maximum impact from the same.

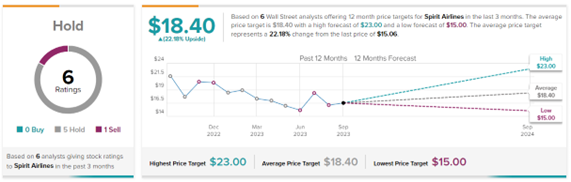

Overall, on TipRanks, SAVE has a Hold consensus rating with five Holds and one Sell rating. The average Spirit Airlines price target of $18.40 implies 22.2% upside potential from current levels. Year-to-date, SAVE stock has lost 18.6%.