Spirit Airlines (NYSE:SAVE) shares are trending marginally higher today after the air carrier announced its results for the fourth quarter. Revenue declined by 5% year-over-year to $1.32 billion. EPS of -$1.36 came in narrower than estimates by $0.06. In comparison, the company had posted an EPS of $0.12 in the year-ago period.

During the quarter, Spirit’s load factor stood at 80.1% (the percentage of available seats filled with passengers), and total revenue per available seat mile (TRASM) declined by 17.3% to 8.94 cents. At the same time, higher flight volume, an increase in leased aircraft, and inflationary challenges contributed to an uptick in the company’s adjusted operating expenses. Sprit had $1.3 billion in total liquidity at the end of Q4.

Spirit is anticipating a rebound in the domestic market and expects a sequential improvement in TRASM in the first quarter. It expects capacity growth for Fiscal Year 2024 to be flat to up in the mid-single digits. Importantly, the company is focusing on consummating its merger with JetBlue (NASDAQ:JBLU) no later than H1 2024. The two companies have appealed a court ruling blocking the merger, and arguments are set for hearing in June.

What Is the Forecast for SAVE Stock?

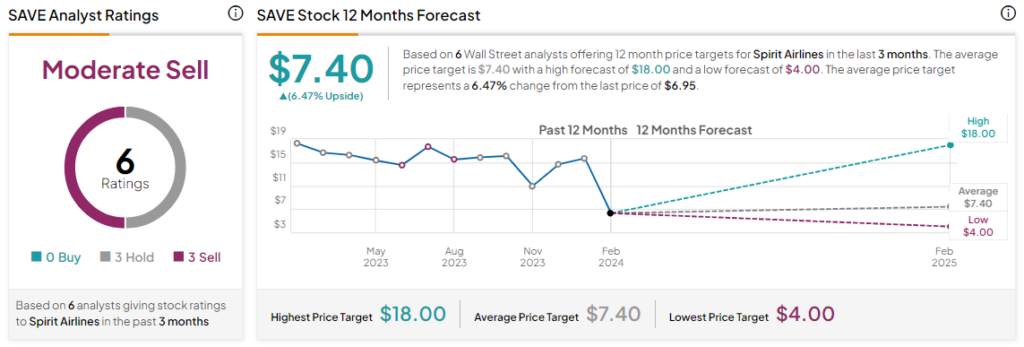

Amid the unfolding merger drama, Spirit shares have declined by nearly 62% over the past year. Overall, the Street has a Moderate Sell consensus rating on Spirit, and the average SAVE price target of $7.40 points to a modest 6.5% potential upside in the stock.

Read full Disclosure