Spirit Airlines (NYSE:SAVE) tanked in trading after JetBlue Airways (NASDAQ:JBLU) warned in a company filing that certain conditions to close the merger may not be met before the merger’s termination date on January 28. As a result, the acquisition may terminate on or after January 28.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

JetBlue stated that the company is evaluating its options under the merger agreement. This is another major setback for Spirit Airlines after a U.S. judge recently decided to block the merger.

Following the decision of the U.S. Court, the two companies filed a joint appeal to the U.S. Court of Appeals. At the same time, SAVE issued an upbeat preliminary earnings update, while JetBlue cut several of its routes as it looks for a return to profitability.

Shares of SAVE have been on a see-saw following the flurry of news about the merger, but overall, for the past five trading sessions, shares have plunged by more than 15%.

Is SAVE a Buy or Sell?

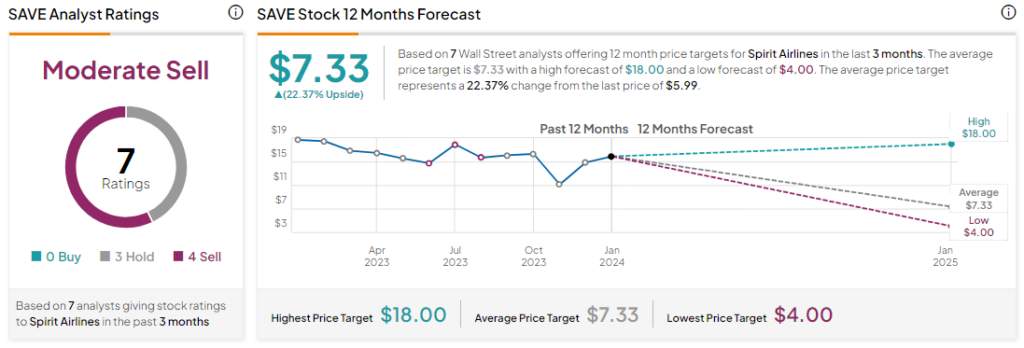

Analysts remain bearish about SAVE stock with a Moderate Sell consensus rating based on three Holds and four Sells. The average SAVE price target of $7.33 implies an upside potential of 22.4% at current levels.