Spirit Airlines (NYSE:SAVE) recently announced an agreement under which International Aero Engines (an affiliate of Pratt & Whitney) will guarantee monthly compensation for the airline’s inability to operate several aircraft due to engine troubles. This deal is expected to boost Spirit’s liquidity by $150 million to $200 million. As part of the arrangement, Spirit has agreed to absolve IAE and its related parties from any legal claims concerning the faulty engines until December 31, 2024.

However, the airline plans to seek further compensation from Pratt & Whitney for any ongoing aircraft unavailability after 2024. Spirit had previously sidelined some A320neo jets for checks following a July notice from Pratt & Whitney about a rare flaw in certain engine components made from powdered metal.

Spirit’s operational issues are compounded by the challenges associated with RTX’s (NYSE:RTX) Pratt & Whitney Geared Turbofan (GTF) engines, with Spirit being the primary operator of GTF-powered fleets in the U.S. Spirit’s difficulties are made worse by increasing expenses and supply chain disruptions, which could lead to liquidity issues as debt starts to mature next year.

Is SAVE Stock a Buy?

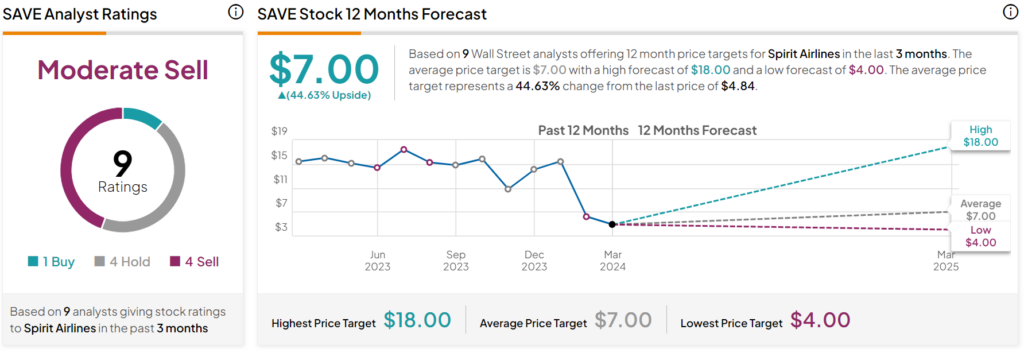

Turning to Wall Street, analysts have a Moderate Sell consensus rating on SAVE stock based on one Buy, four Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 69% decline in its share price over the past year, the average SAVE price target of $7 per share implies 44.63% upside potential.