It’s a great day for Spirit Aerosystems (NYSE:SPR), who just signed a big new deal with one of its main customers, aerospace stock Boeing (NYSE:BA). The move was sufficient to send Spirit’s stock price up to a high not seen in the last two months, and Spirit was up over 23% in Wednesday afternoon’s trading as a result. The move comes despite some recent troubles at Spirit Aerosystems, where it had some issues manufacturing fuselages that were used in Boeing’s 737 Max aircraft. But with this latest deal, Spirit looks to be able to not only boost its production but also improve its overall production quality and its predictability as well.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The deal calls for Spirit to earn a higher rate for each 787 Dreamliner fuselage it produces for now while also taking a reduction on its 737 production between 2026 and 2033. The move means an extra $455 million in sales from 2023 to 2025, but starting in 2026, it would lose around $265 million in revenues until 2033. Meanwhile, Boeing also agreed to alter payment schedules on some outstanding debt.

The move comes at a great time for Spirit, who also noted today that its third-quarter revenue would likely come in below expectations. That’s thanks in large part to those aforementioned quality issues supplying Boeing and also part of why Boeing offered up the deal to Spirit in the first place. While quality and revenue were down this quarter, that’s likely to improve going forward, at least for a while.

Is Spirit Aerosystems Stock a Good Buy?

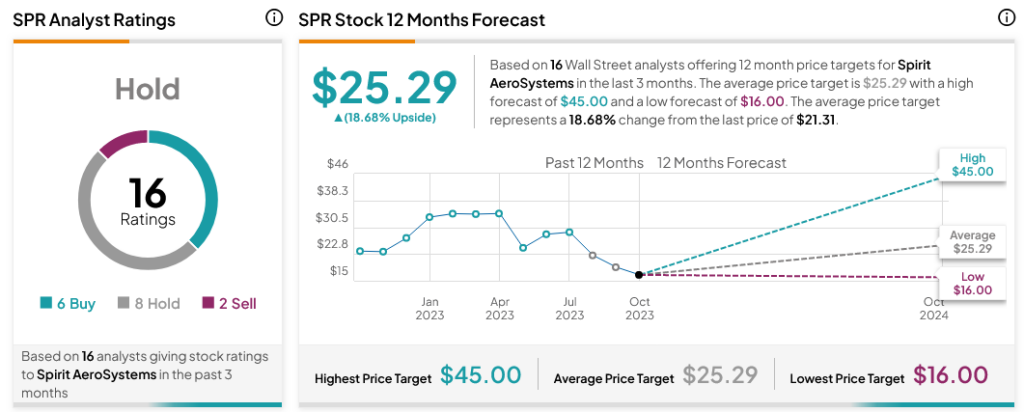

Turning to Wall Street, analysts have a Hold consensus rating on SPR stock based on six Buys, eight Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPR price target of $25.29 per share implies 18.68% upside potential.