Boeing (NYSE:BA) and Spirit AeroSystems (NYSE:SPR) have broadened the scope of their ongoing inspections to address a production defect impacting 737 Max 8 aircraft. The defect has not only caused delivery delays for 737 Max 8s but also affected the stock’s performance. Since the problem was discovered on August 24, Boeing’s stock has declined by about 16%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The defect was related to the fastener holes on the aft pressure bulkhead of some planes that were inaccurately drilled. It is worth mentioning that the flaw was identified in Spirit-provided components.

The companies were initially examining holes drilled in the bulkhead using an automated drill. But now, Boeing and Spirit have expanded the inspection to include hand-drilled holes as well.

Boeing has faced issues related to components from its supplier, Spirit, in the past as well. In April 2023, problems related to fittings that connected the aft fuselage to the vertical tail were identified, impacting multiple 737 MAX aircraft models.

737 MAX Aircraft Deliveries Hampered

The latest update is expected to slow down deliveries of 737 MAX aircraft. Earlier this week, Boeing said it delivered just 15 units of the aircraft in September, which is the lowest delivery since May 2021.

These persistent quality challenges make it difficult for Boeing to achieve its 2023 delivery target of 400 to 450 jets. For the nine months ended September, Boeing delivered 286 Max planes.

In a research note to investors on October 11, Susquehanna analyst Charles Minervino noted that deliveries in September could continue to remain weak. However, he views the deliveries of the 787 Dreamliner jet and the substantial order volumes as positive signs, indicating robust demand within Boeing’s Commercial portfolio. As a result, Minervino maintained his Buy rating on BA stock with a $270 price target.

Is BA Stock a Good Buy Now?

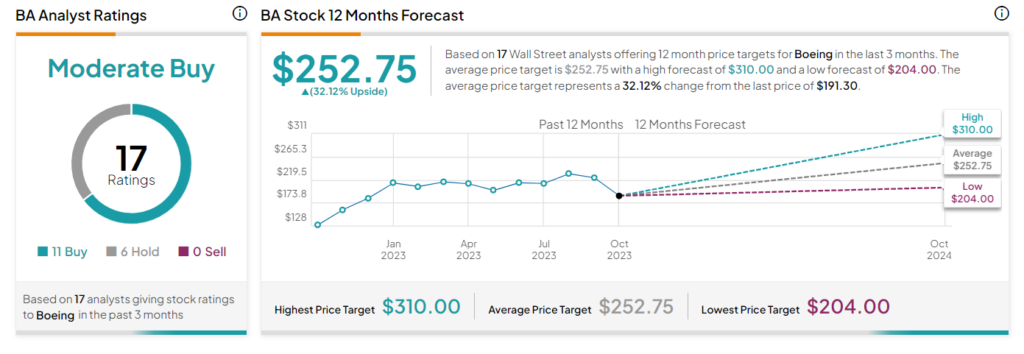

Overall, Wall Street remains cautiously optimistic about Boeing’s prospects. On TipRanks, BA has a Moderate Buy consensus rating based on 11 Buys and six Hold ratings. The average Boeing stock prediction of $252.75 implies 32.1% upside potential from current levels. The stock has declined 2.1% year to date.