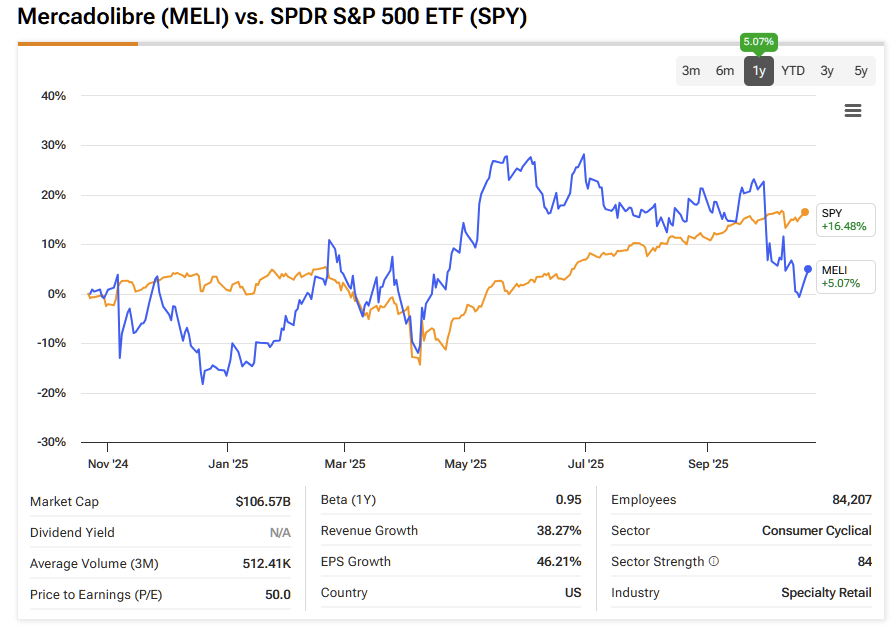

MercadoLibre (MELI) has seemed unusually sluggish this year. Over the past 12 months, the stock has remained flat, seriously lagging behind the S&P 500’s roughly 15% gain, despite the company reporting growth numbers that would typically lead to substantial rallies for most of its North American peers. This disconnect is the key issue at hand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While MELI is certainly navigating some real challenges, its valuation has dropped to multi-year lows even as the business keeps expanding at an exceptional pace. At these levels, I view the stock as an attractive buy-the-dip opportunity—particularly with the highly anticipated Q3 earnings report coming next week, which could serve as a catalyst for a rebound toward prior highs around $2,500 per share.

Why MELI is Under Pressure

Of course, the lag in share price isn’t entirely unwarranted. Some short-term bruises are real. In June, management slashed Brazil’s free-shipping threshold to just 19 reais to counter intensifying competition from Amazon (AMZN), Shopee, and Temu, and then went further by cutting seller shipping costs.

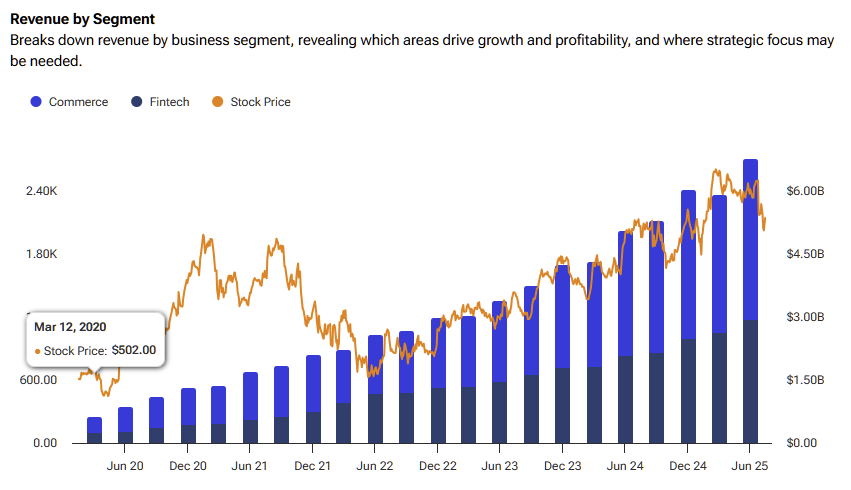

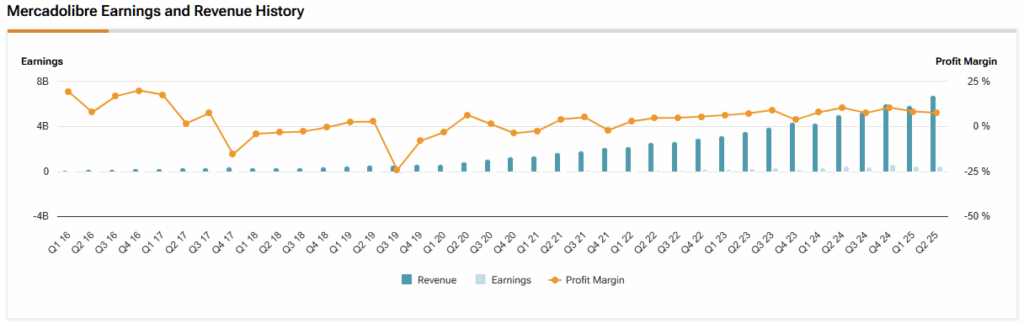

The move is positive for MELI’s growth, but not for margins, as Q2 results showed. Revenue climbed 34% year over year to $6.79 billion, yet the EBIT margin tightened to around 12% as Brazil’s shipping incentives worked a little too well. Items sold surged 31% and GMV accelerated, but profits fell short of expectations, sending the stock lower.

Adding to the pressure, the macro backdrop has been far from friendly. Brazil’s central bank continues to enforce a punishing 15% benchmark rate—a deliberate move to rein in stubborn core inflation. That keeps consumer credit tight and the cost of capital elevated, directly affecting Mercado Pago’s rapidly expanding loan book.

Meanwhile, Argentina—another key market—remains a source of constant volatility. Fresh FX turmoil underscores how quickly currency swings can distort MELI’s dollar-reported results. More broadly, Latin America’s growth is projected to cool in the second half of 2025, creating a cocktail of headwinds that naturally unsettles investors.

Momentum Is Still Running Hot

Despite the headwinds weighing on sentiment, MELI’s operating momentum remains impressive. Even in a “slower” quarter, Q2 revenue climbed 34% year-over-year, with operating income reaching $825 million and net income at $523 million. Total payment volume hit $64.6 billion, up 39%, while marketplace activity re-accelerated—helped by the shipping adjustments mentioned earlier. Management is deliberately giving up a point or two of margin to boost frequency and conversion in Brazil—and the data suggest it’s working.

I also like the near-term setup. Consensus calls for roughly $7.19 billion in Q3 revenue and around $9.9–$10.3 in EPS.

Using last year’s Q3 base of about $5.3 billion, that implies ~36% year-over-year growth—hardly the profile of a company losing momentum. In fact, it points to an acceleration from Q2. I expect the fintech arm to be a major growth driver again, with Mercado Pago’s credit portfolio up ~91% year over year to $9.3 billion in Q2. Management continues to balance expansion and risk, keeping NPLs under control—a sign that monetization beyond the marketplace is taking hold.

And if those numbers still sound too good to last, consider this: MELI hasn’t reported a single quarter of sub-30% revenue growth since Q4 2018. That’s nothing short of remarkable.

A High-Growth Giant at a Value Multiple

MELI’s relentless growth against its lagging stock price has created a situation where you can get your hands on a stellar growth stock at a discount, in my view. Shares are trading at a forward P/S of 3.4x, one of the lowest multiples in its history and well below their 5-year average of around 7x.

From a forward P/E perspective, we see a multiple of about 40x, which may sound steep in a vacuum, especially given that the sector median stands at about 19x. Yet, not for a platform that is still growing revenue by ~30% with a powerful fintech kicker, I don’t think that’s expensive at all.

For context, the company’s EPS is projected to has grow at a CAGR of 171% over the next five years, with analysts expecting 32% annual growth until 2030, meaning the stock should grow into today’s multiple with ease. Also, analysts have historically been quite conservative with MELI, and so I believe its actual growth will end up being relatively stronger than today’s consensus.

Is MELI Stock a Buy, Sell, or Hold?

Wall Street seems quite bullish on Mercadolibre, despite the stock’s relatively soft performance. The stock is now carrying a Strong Buy consensus rating based on 13 Buy and two Hold ratings over the past three months. Notably, not a single analyst is bearish on the stock. Moreover, MELI’s average stock price target of $2,861.67 suggests ~33% upside from current levels.

Buying the MELI Dip Despite Short-Term Noise

To wrap up, I believe MercadoLibre’s stock is mispriced relative to its performance. Short-term margin pressure and macro noise are obscuring what’s really happening beneath the surface—accelerating GMV, resilient fintech monetization, and rare, sustained 30%+ growth.

With consensus expectations strengthening into Q3 and the stock trading at a historically compressed multiple, I see an attractive asymmetry: limited downside and significant upside as margins recover and the credit business scales responsibly. I’m taking advantage of the weakness and letting long-term compounding do the heavy lifting.