At first glance, discount airfare specialist Southwest Airlines (NYSE:LUV) seems like a risky idea. Broadly, the sector faces challenges due to relatively poor consumer sentiment. Specific to Southwest, the company is exposed to the woes impacting airplane manufacturer Boeing (NYSE:BA). Still, a change in travel trends may boost the airliner. Therefore, I am bullish on LUV stock.

LUV Stock Undeniably Encountered Turbulent Weather

Although patient investors could potentially be rewarded with Southwest, it would be remiss to suggest that LUV stock does not incur risks. On the contrary, it’s one of the more “adventurous” ideas in the space, which is why analysts aren’t exactly keen on the idea.

The first major challenge for Southwest’s business is the state of the consumer economy. According to the consumer sentiment index, February’s score was 76.9. However, the index has never dropped below 80 points from February 2014 through February 2020. Granted, consumer sentiment has been improving since reaching a low in June 2022. Nevertheless, compared to prior cycles, people simply don’t feel particularly confident about the economy.

Yes, the latest nonfarm payrolls jumped to 303,000 in March. This stat compares favorably to the 270,000 jobs added in the prior month. However, context matters. Most notably, inflation continues to impose significant obstacles on everyday American households. Even worse, the robust jobs print also means more dollars are chasing after fewer goods. That’s inflationary.

Of course, economic headwinds affect the entire airline industry. For stakeholders of LUV stock, though, the issue is that Boeing’s troubles have a disproportionate impact on Southwest. That’s for the very simple reason that Southwest only flies Boeing airplanes. Therefore, the plane manufacturer’s worrisome safety issues present huge obstacles for the discount airliner.

The pain is evident in the chart itself. Since the beginning of the year, LUV stock has fallen by 0.3%. In sharp contrast, Delta Air Lines (NYSE:DAL) is up 17% during the same period. As if that wasn’t enough of a rough comparison, DAL stock enjoys a Strong Buy rating from analysts. Further, the average price target for the stock comes in at $55.50 (17.8% upside potential), with the most optimistic target reaching $85.

Nevertheless, contrarian investors shouldn’t be too quick to give up on LUV stock. Here’s why.

Travel Prioritization May Benefit Southwest More Than Rivals

According to a Deloitte research paper, the phenomenon of revenge travel may be waning. However, in its place is a new era of travel prioritization that may be emerging. If so, LUV stock could be a key beneficiary.

Fundamentally, what the data demonstrates is that consumers will likely continue spending on “experiential” services, irrespective (to a point) of broader economic pressures. It also means that airliners such as Southwest can depend on a relatively predictable forward revenue stream.

Yes, it’s true that if travel sentiment rises, the rising tide should lift all boats. However, when a wider tailwind materializes, it’s rare – if it occurs at all – for every company within the impacted sector to benefit perfectly evenly.

LUV stock has been beaten down relative to other airliners. As stated earlier, that’s for a reason, particularly the exposure to Boeing. However, the bad news may already be baked in. Yes, Boeing’s safety issues are certainly ugly. However, they’re now a well-known issue. Moving forward, then, LUV may have a longer upside pathway compared to rivals.

It’s worth noting that Southwest’s most recent earnings report for the fourth quarter was rather impressive. Against an estimated earnings target of 12 cents per share, the airliner posted EPS of 37 cents. On the top line, the company rang up sales of $6.82 billion, beating out the forecast calling for $6.75 billion. Should the airliner continue to build momentum into Q1, LUV stock could fly higher.

For the current fiscal year, analysts anticipate EPS to reach $1.63 on revenue of $28.43 billion. In 2023, earnings landed at $1.57 per share on sales of $26.09 billion. Therefore, the expectation is that Southwest will post earnings and revenue growth of 3.82% and 8.9%, respectively.

These stats compare favorably to many of Southwest’s rivals. For example, Wall Street expects Delta’s earnings and sales growth to reach 3% and 4.4%, respectively. More significantly, few people believe that Southwest can deliver good results. Therefore, even a modest beat against the forecast could lead to an outsized performance for LUV stock.

Options Data Seems Bullish for LUV Stock

Finally, one additional factor to consider is the options market. Since March 26, it appears that the biggest transactions (as defined by volume relative to prior open interest) regarding options flow have leaned toward the bullish side of the spectrum; in other words, bought calls and sold puts.

To be sure, implied sentiment from options flow data doesn’t guarantee anything. However, it does provide a possible indicator as to what the big players are thinking. Options flow screeners focus exclusively on big block transactions likely made by institutions. Naturally, these investors carry far more influence than your average retail investor.

Is LUV Stock a Buy, According to Analysts?

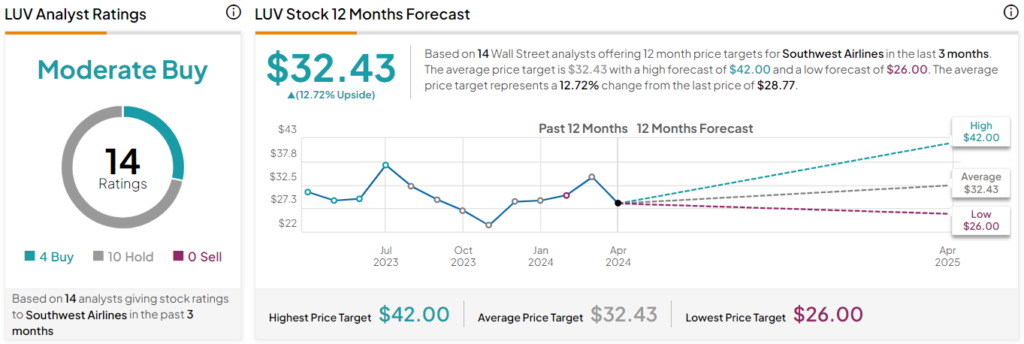

Turning to Wall Street, LUV stock has a Hold consensus rating based on four Buys, 10 Holds, and zero Sell ratings. The average LUV stock price target is $32.43, implying 12.7% upside potential.

The Takeaway: LUV Stock Just Might Surprise the Pessimists

Looking at Southwest Airlines from the top down, it appears to be an incredibly troubled enterprise. Because all its jetliners are built by Boeing, it suffers from the plane manufacturer’s troubles. However, this is also likely a baked-in headwind. If the company could somehow leverage sentiment shifts in the travel industry, LUV stock could be a surprisingly bullish contrarian opportunity.